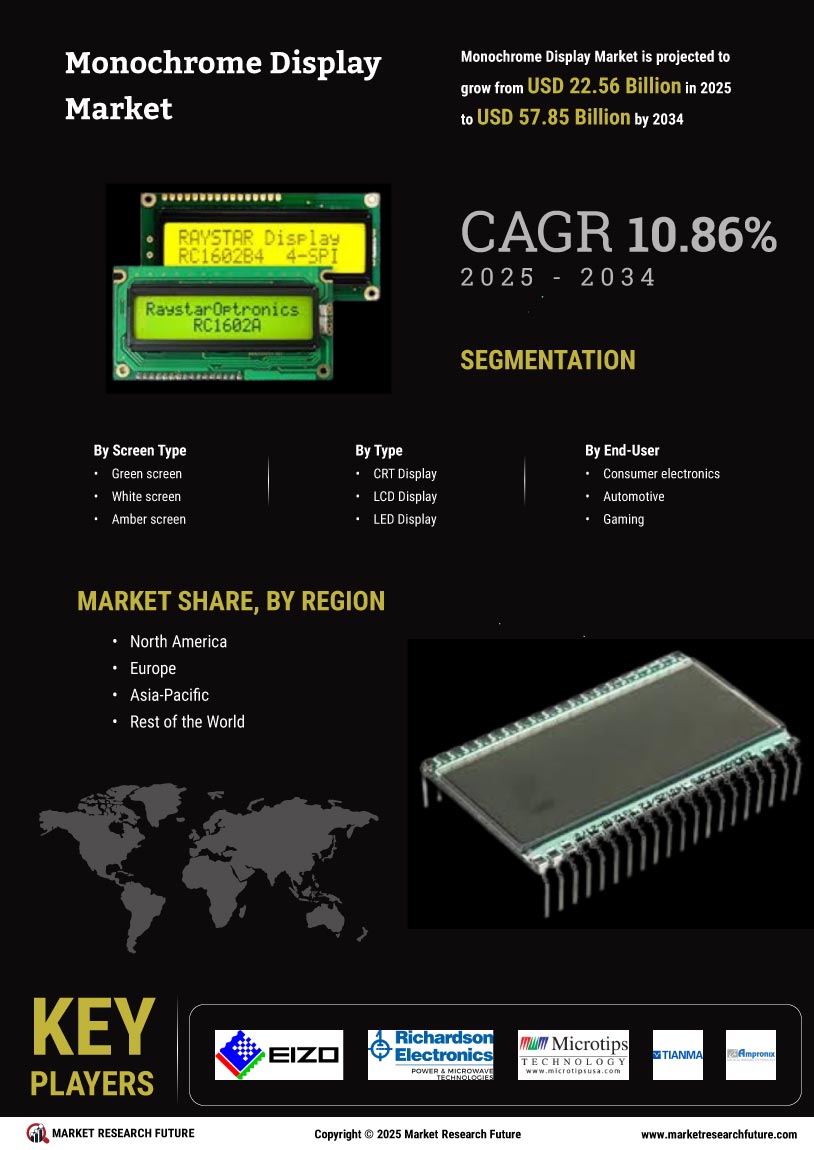

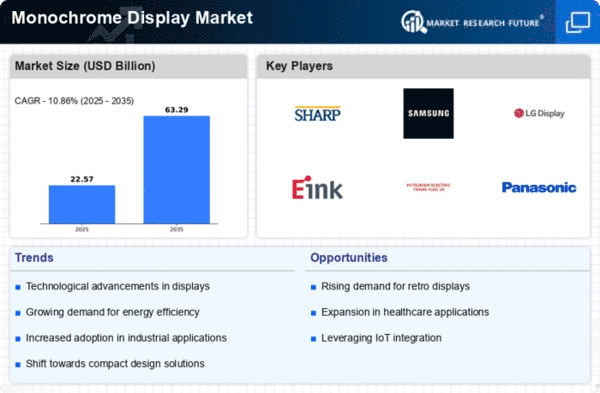

Market Growth Projections

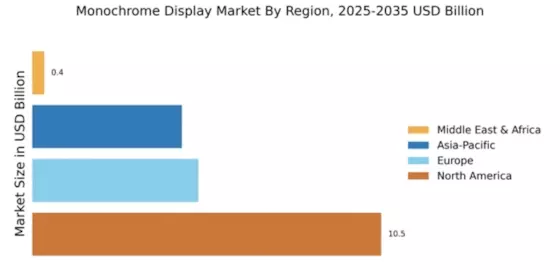

The Global Monochrome Display Market Industry is poised for substantial growth, with projections indicating a market size of 18.6 USD Billion in 2024 and an anticipated increase to 64.1 USD Billion by 2035. This growth trajectory suggests a robust compound annual growth rate (CAGR) of 11.89% from 2025 to 2035. The expansion is driven by various factors, including technological advancements, increased adoption in healthcare, and the rising demand for energy-efficient solutions. As industries continue to recognize the benefits of monochrome displays, the market is likely to experience sustained growth, reflecting the evolving needs of consumers and businesses alike.

Growing Demand in Industrial Automation

The Global Monochrome Display Market Industry benefits from the growing demand in industrial automation. Monochrome displays are widely used in control panels, machinery interfaces, and monitoring systems due to their clarity and ease of readability in various lighting conditions. As industries continue to adopt automation technologies to enhance efficiency and productivity, the need for reliable display solutions becomes more pronounced. This trend is reflected in the anticipated market growth, with projections indicating a substantial increase in demand for monochrome displays in industrial applications. The integration of these displays into automated systems is expected to drive significant advancements in the market.

Cost-Effectiveness of Monochrome Displays

Cost-effectiveness remains a pivotal driver in the Global Monochrome Display Market Industry. Monochrome displays typically require less complex manufacturing processes and materials, resulting in lower production costs compared to color displays. This affordability makes them an attractive option for various industries, including retail and transportation, where budget constraints are prevalent. Additionally, the longevity and durability of monochrome displays reduce replacement costs, further enhancing their appeal. As businesses seek to optimize their expenditures, the demand for cost-effective monochrome display solutions is likely to increase, supporting the market's growth trajectory in the coming years.

Rising Demand for Energy-Efficient Displays

The Global Monochrome Display Market Industry experiences a surge in demand for energy-efficient display technologies. As organizations increasingly prioritize sustainability, monochrome displays, known for their lower power consumption compared to color displays, become more appealing. This trend is particularly evident in sectors such as healthcare and industrial automation, where energy efficiency is paramount. The market is projected to reach 18.6 USD Billion in 2024, driven by the need for cost-effective solutions that reduce operational expenses. Furthermore, the anticipated growth in the market highlights the potential for monochrome displays to play a crucial role in achieving energy-saving goals.

Increased Adoption in Healthcare Applications

The Global Monochrome Display Market Industry sees increased adoption in healthcare applications, where reliability and clarity are critical. Monochrome displays are widely utilized in medical imaging devices, such as ultrasound machines and X-ray systems, due to their ability to provide clear and precise images. The growing emphasis on diagnostic accuracy and patient safety drives the demand for these displays in hospitals and clinics. As healthcare technology advances, the need for high-quality monochrome displays is expected to rise, contributing to the overall market growth. This trend aligns with the projected CAGR of 11.89% from 2025 to 2035, indicating a robust future for monochrome displays in healthcare.

Technological Advancements in Display Technology

Technological advancements significantly influence the Global Monochrome Display Market Industry. Innovations in display technology, such as improved resolution and enhanced contrast ratios, contribute to the growing adoption of monochrome displays across various applications. For instance, the integration of advanced LCD and OLED technologies allows for sharper images and better visibility in challenging environments. These advancements not only enhance user experience but also expand the potential applications of monochrome displays in sectors like automotive and aerospace. As the market evolves, these technological improvements are likely to drive growth, with projections indicating a market size of 64.1 USD Billion by 2035.