Regulatory Compliance and Standards

the medical image-management market in Spain is influenced by stringent regulatory compliance and standards. Healthcare institutions are required to adhere to various regulations regarding patient data protection and imaging quality. The implementation of the General Data Protection Regulation (GDPR) has heightened the focus on data security and patient privacy, compelling organizations to invest in compliant image-management solutions. This regulatory landscape is expected to drive market growth, as healthcare providers seek systems that not only meet legal requirements but also enhance operational efficiency. The emphasis on compliance is likely to result in an increased market size, with projections indicating a growth rate of around 8% annually in the coming years.

Growing Focus on Patient-Centric Care

the medical image-management market in Spain is driven by a growing focus on patient-centric care. Healthcare providers are prioritizing patient engagement and satisfaction, which necessitates the implementation of efficient image-management systems. These systems enable better communication of imaging results to patients and facilitate shared decision-making. As the healthcare landscape evolves towards more personalized care, the demand for solutions that enhance the patient experience is expected to rise. This shift is likely to contribute to a market growth rate of approximately 10% annually, as providers seek to integrate patient feedback into their imaging processes and improve overall service delivery.

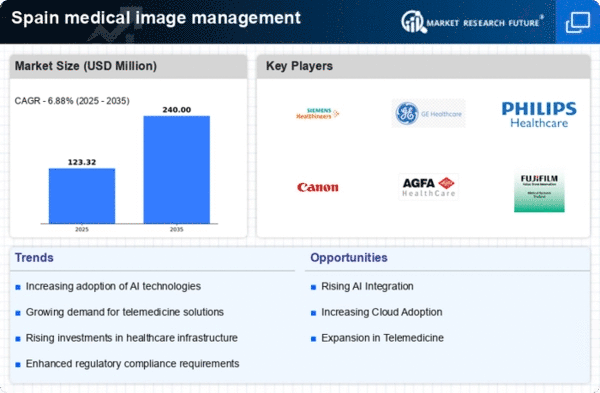

Rising Demand for Telemedicine Solutions

the medical image-management market in Spain is seeing rising demand for telemedicine solutions, which is reshaping the landscape of healthcare delivery. As remote consultations become more prevalent, the need for efficient image-sharing and management systems is paramount. Telemedicine facilitates timely diagnosis and treatment, particularly in rural areas where access to specialists may be limited. The market for telemedicine in Spain is anticipated to grow at a CAGR of 12% through 2025, further driving the need for robust image-management solutions that can support remote access to medical images. This trend indicates a shift towards integrated healthcare systems, where seamless communication and image management are essential components.

Technological Advancements in Imaging Equipment

the medical image-management market in Spain is surging due to rapid technological advancements in imaging equipment. Innovations such as high-resolution MRI and CT scanners are enhancing diagnostic accuracy and efficiency. The integration of advanced imaging modalities is expected to increase the demand for sophisticated image-management solutions. In 2025, the market for imaging equipment in Spain is projected to reach approximately €1.5 billion, indicating a robust growth trajectory. This growth is likely to drive the need for effective image management systems that can handle the increased volume and complexity of medical images. As healthcare providers seek to improve patient outcomes, the adoption of cutting-edge imaging technologies will be a key driver in the medical image-management market.

Increased Investment in Healthcare Infrastructure

The medical image-management market in Spain is benefiting from increased investment in healthcare infrastructure. The Spanish government has been allocating substantial funds to modernize healthcare facilities, which includes upgrading imaging technologies and associated management systems. This investment is expected to enhance the quality of care and improve patient outcomes. In 2025, public spending on healthcare is projected to reach €200 billion, with a significant portion directed towards imaging and diagnostic services. As healthcare facilities expand and modernize, the demand for advanced image-management solutions is likely to rise, positioning the market for substantial growth in the coming years.