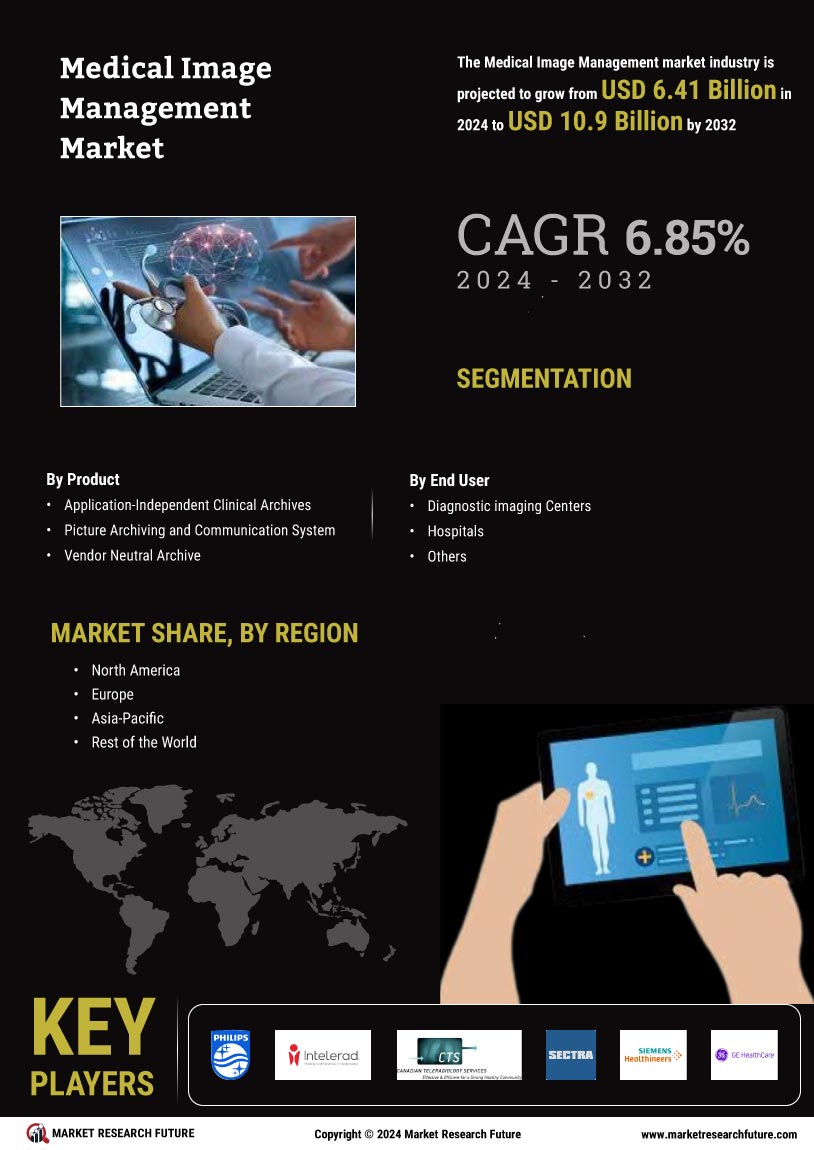

Rising Demand for Diagnostic Imaging

The increasing prevalence of chronic diseases and the aging population are driving the demand for diagnostic imaging services. As healthcare providers seek to enhance patient outcomes, the Medical Image Management Market is experiencing a surge in the utilization of imaging technologies. According to recent data, the demand for imaging services is projected to grow at a compound annual growth rate of approximately 6.5% over the next few years. This growth is attributed to the need for early disease detection and monitoring, which necessitates efficient management of medical images. Consequently, healthcare facilities are investing in advanced medical image management solutions to streamline workflows and improve diagnostic accuracy. The integration of these solutions is expected to facilitate better patient care and optimize resource allocation within healthcare systems.

Growing Focus on Patient-Centric Care

The shift towards patient-centric care is reshaping the Medical Image Management Market. Healthcare providers are increasingly prioritizing patient engagement and satisfaction, which necessitates the efficient management of medical images. By implementing advanced image management solutions, healthcare organizations can provide patients with timely access to their imaging results, thereby enhancing transparency and trust. Additionally, the ability to share images seamlessly among different healthcare providers fosters collaborative care, which is essential for comprehensive treatment plans. As the emphasis on patient-centric approaches continues to grow, the demand for effective medical image management systems that support these initiatives is likely to rise, further driving market expansion.

Regulatory Compliance and Quality Assurance

The Medical Image Management Market is significantly influenced by the need for regulatory compliance and quality assurance in healthcare. Regulatory bodies are increasingly emphasizing the importance of maintaining high standards in medical imaging practices. Compliance with regulations such as HIPAA and FDA guidelines necessitates the implementation of robust image management systems that ensure data security and patient privacy. As healthcare organizations strive to meet these regulatory requirements, they are investing in advanced medical image management solutions that facilitate compliance and enhance operational efficiency. This trend is expected to drive market growth, as organizations recognize the importance of adhering to regulations while improving the quality of care provided to patients.

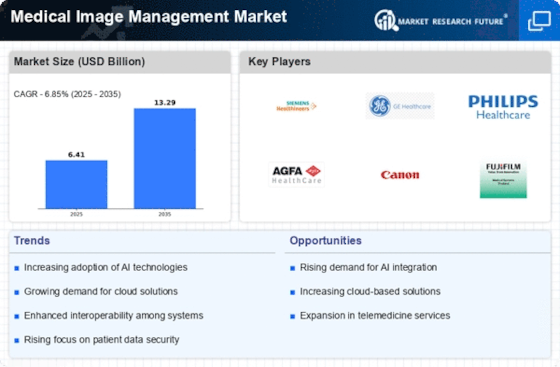

Increase in Research and Development Activities

The Medical Image Management Market is witnessing a notable increase in research and development activities aimed at enhancing imaging technologies and management solutions. Academic institutions and healthcare organizations are investing in R&D to explore innovative imaging techniques and improve existing medical image management systems. This focus on innovation is expected to lead to the development of more efficient and effective solutions that can address the evolving needs of healthcare providers. Furthermore, collaborations between technology companies and healthcare institutions are likely to accelerate advancements in medical imaging, resulting in a more competitive market landscape. As R&D efforts continue to flourish, the Medical Image Management Market is poised for substantial growth.

Technological Advancements in Imaging Modalities

Technological innovations in imaging modalities, such as MRI, CT, and ultrasound, are significantly influencing the Medical Image Management Market. The introduction of high-resolution imaging and advanced visualization techniques enhances diagnostic capabilities, leading to improved patient outcomes. For instance, the development of portable imaging devices has made it easier for healthcare providers to conduct imaging in various settings, including remote locations. Furthermore, the integration of 3D imaging and augmented reality in medical imaging is revolutionizing the way healthcare professionals interpret images. As these technologies continue to evolve, the demand for sophisticated image management solutions that can handle large volumes of data and provide seamless access to images is likely to increase, thereby propelling market growth.