Rising Healthcare Expenditure

The increasing healthcare expenditure in Spain is a vital driver for the intravascular catheter market. With the government and private sectors investing more in healthcare infrastructure, the availability of advanced medical devices is improving. In 2025, healthcare spending in Spain is expected to reach approximately €200 billion, reflecting a growth rate of around 5% annually. This financial commitment allows hospitals to procure state-of-the-art intravascular catheters, thereby enhancing patient care. Furthermore, as healthcare budgets expand, there is a greater emphasis on adopting innovative technologies that improve treatment efficacy. Consequently, the rising healthcare expenditure is likely to foster a conducive environment for the growth of the intravascular catheter market.

Growing Focus on Patient Safety

Patient safety has become a paramount concern in the healthcare sector, influencing the intravascular catheter market significantly. In Spain, healthcare institutions are implementing stringent protocols to minimize the risk of catheter-related infections and complications. This focus on safety is driving the demand for high-quality, reliable intravascular catheters. Recent studies indicate that the adoption of safety-engineered catheters can reduce infection rates by up to 30%, which is a compelling incentive for healthcare providers. As hospitals strive to enhance patient outcomes and comply with regulatory standards, the emphasis on safety is likely to propel the growth of the intravascular catheter market in Spain.

Increased Awareness and Education

There is a growing awareness and education regarding the benefits of intravascular catheters among healthcare professionals in Spain. Training programs and workshops are being organized to educate medical staff about the latest advancements in catheter technology and best practices for their use. This increased knowledge base is likely to lead to more informed decision-making in clinical settings, thereby driving the demand for intravascular catheters. As healthcare providers become more adept at utilizing these devices, the market may experience a notable uptick in usage rates. Moreover, patient education initiatives are also contributing to this trend, as informed patients are more likely to seek out advanced treatment options, further propelling the intravascular catheter market.

Advancements in Medical Technology

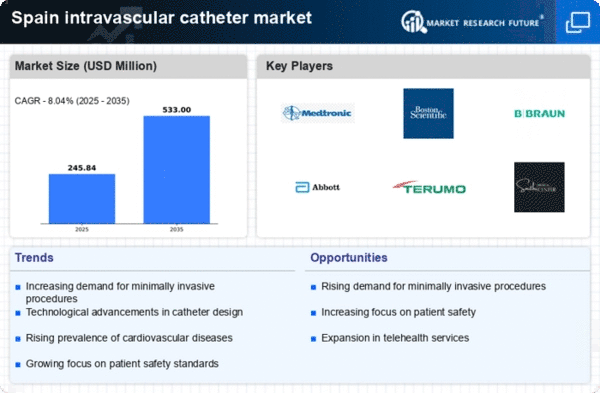

Technological innovations in the medical field are transforming the intravascular catheter market. The introduction of smart catheters equipped with sensors and real-time monitoring capabilities enhances patient safety and improves clinical outcomes. In Spain, the healthcare sector is increasingly adopting these advanced technologies, which may lead to a projected market growth of around 15% annually over the next five years. Additionally, the development of biocompatible materials for catheter manufacturing reduces the risk of complications, further driving market demand. As hospitals and clinics invest in state-of-the-art equipment, the intravascular catheter market is likely to benefit from these advancements, ensuring that healthcare providers can offer high-quality care to patients.

Increasing Prevalence of Chronic Diseases

The rising incidence of chronic diseases in Spain, such as cardiovascular disorders and diabetes, is a crucial driver for the intravascular catheter market. As these conditions necessitate frequent medical interventions, the demand for intravascular catheters is likely to increase. According to recent health statistics, approximately 25% of the Spanish population suffers from chronic illnesses, which may lead to a higher requirement for catheterization procedures. This trend suggests that healthcare providers will increasingly rely on intravascular catheters to manage patient care effectively. Furthermore, the aging population in Spain, which is projected to reach 30% of the total population by 2030, could further amplify the need for these medical devices. Thus, the growing prevalence of chronic diseases appears to be a significant factor driving the intravascular catheter market in Spain.