Expansion of Healthcare Infrastructure

The Intravascular Catheter Market is benefiting from the expansion of healthcare infrastructure in various regions. As countries invest in improving their healthcare systems, the availability of advanced medical technologies, including intravascular catheters, is increasing. This expansion is particularly evident in emerging markets, where healthcare facilities are being upgraded to meet rising patient demands. Enhanced access to healthcare services is likely to drive the adoption of intravascular catheters, as more facilities incorporate these devices into their treatment protocols. Projections indicate that this trend could lead to a significant increase in market penetration, potentially resulting in a multi-billion dollar growth trajectory for the industry in the coming years.

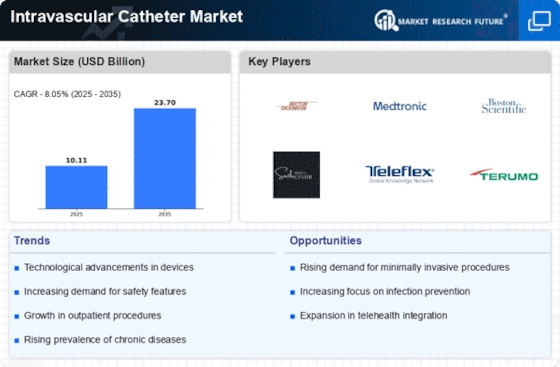

Growing Prevalence of Chronic Diseases

The Intravascular Catheter Market is significantly influenced by the growing prevalence of chronic diseases, such as diabetes and cardiovascular disorders. These conditions often necessitate frequent medical interventions, including the use of intravascular catheters for drug administration and monitoring. As the global population ages, the incidence of chronic diseases is expected to rise, thereby increasing the demand for effective catheter solutions. Market analysts project that the rise in chronic disease cases could lead to a substantial uptick in catheter utilization, with estimates suggesting that the market could expand by several billion dollars over the next decade as healthcare systems adapt to these changing needs.

Focus on Patient Safety and Quality of Care

The Intravascular Catheter Market is increasingly prioritizing patient safety and quality of care. Healthcare institutions are implementing stringent protocols to minimize the risks associated with catheter use, such as infections and thrombosis. This focus is driving the development of advanced catheters designed with safety features, such as retractable needles and integrated safety mechanisms. Regulatory bodies are also emphasizing the importance of safety standards, which could lead to increased compliance costs for manufacturers. However, this heightened focus on safety is likely to foster innovation within the industry, as companies strive to meet these standards while enhancing the overall quality of care provided to patients.

Rising Demand for Minimally Invasive Procedures

The Intravascular Catheter Market is witnessing a notable increase in the demand for minimally invasive procedures. Patients and healthcare providers alike are gravitating towards techniques that promise reduced recovery times and lower risks of complications. This trend is particularly evident in surgical settings where intravascular catheters are utilized for various applications, including drug delivery and fluid management. The shift towards outpatient care models further propels this demand, as patients prefer procedures that allow for quicker discharge. Market data suggests that the minimally invasive segment is expected to account for a substantial share of the intravascular catheter market, potentially reaching a valuation of several billion dollars in the coming years.

Technological Advancements in Intravascular Catheter Market

The Intravascular Catheter Market is experiencing a surge in technological advancements that enhance the efficacy and safety of catheterization procedures. Innovations such as antimicrobial coatings and advanced materials are being developed to reduce infection rates and improve patient outcomes. For instance, the introduction of smart catheters equipped with sensors allows for real-time monitoring of patient vitals, which could potentially lead to timely interventions. Furthermore, the integration of imaging technologies with catheters is likely to facilitate more precise placements, thereby minimizing complications. As these technologies evolve, they are expected to drive the demand for intravascular catheters, with projections indicating a compound annual growth rate of around 6% over the next few years.