Growing Emphasis on Data Security

As the internet of-things-in-healthcare market expands in Spain, the emphasis on data security becomes increasingly critical. With the proliferation of connected devices, the risk of data breaches and cyber threats escalates, prompting healthcare organizations to invest in robust cybersecurity measures. Recent statistics reveal that 30% of healthcare organizations in Spain have reported cyber incidents in the past year. Consequently, there is a growing demand for IoT solutions that incorporate advanced security features to protect sensitive patient information. This focus on data security not only safeguards patient trust but also ensures compliance with stringent regulations, thereby driving the adoption of secure IoT technologies in the healthcare sector.

Government Initiatives and Funding

Government initiatives play a pivotal role in the growth of the internet of-things-in-healthcare market in Spain. The Spanish government has recognized the potential of IoT technologies in enhancing healthcare services and has allocated substantial funding to support innovation in this sector. Recent reports indicate that public investment in digital health initiatives is projected to exceed €500 million by 2025. These funds are aimed at developing IoT infrastructure, promoting research, and facilitating the adoption of smart healthcare solutions. Such government backing not only fosters innovation but also encourages private sector participation, creating a robust ecosystem for the internet of-things-in-healthcare market.

Integration of Artificial Intelligence

The integration of artificial intelligence (AI) into the internet of-things-in-healthcare market is transforming patient care in Spain. AI technologies facilitate advanced data analysis, enabling healthcare professionals to make informed decisions based on real-time data collected from IoT devices. This capability is particularly crucial in predictive analytics, where AI can identify potential health risks before they escalate. The Spanish healthcare system is increasingly adopting AI-driven solutions, with investments in this area expected to reach €1 billion by 2026. This integration not only improves patient outcomes but also streamlines operational efficiencies, making healthcare delivery more effective and responsive to patient needs.

Increased Focus on Patient-Centric Care

The shift towards patient-centric care is significantly influencing the internet of-things-in-healthcare market in Spain. Healthcare providers are increasingly prioritizing patient engagement and satisfaction, leading to the adoption of IoT solutions that enhance the patient experience. Technologies such as wearable devices and mobile health applications empower patients to take control of their health, fostering a collaborative relationship between patients and providers. This trend is reflected in a survey indicating that 70% of patients prefer healthcare services that incorporate IoT technologies. As healthcare systems adapt to this demand, the market is likely to expand, driven by innovations that prioritize patient needs and preferences.

Rising Demand for Remote Patient Monitoring

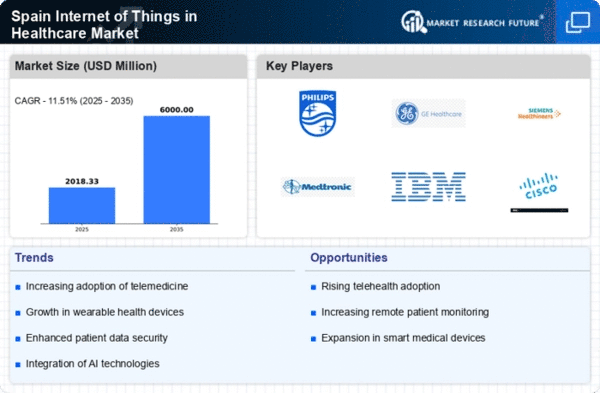

The internet of-things-in-healthcare market in Spain is experiencing a notable surge in demand for remote patient monitoring solutions. This trend is driven by an increasing aging population, which necessitates continuous health monitoring. According to recent data, approximately 19% of the Spanish population is over 65 years old, leading to a higher prevalence of chronic diseases. Remote monitoring devices enable healthcare providers to track patients' vital signs in real-time, reducing the need for hospital visits. This shift not only enhances patient convenience but also optimizes resource allocation within healthcare facilities. As a result, the market for remote monitoring solutions is projected to grow significantly, with estimates suggesting a compound annual growth rate (CAGR) of around 25% over the next five years.

Leave a Comment