Advancements in IoT Technology

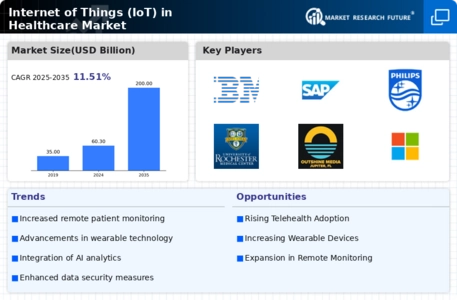

Technological advancements play a crucial role in the evolution of the Internet of Things (IoT) in Healthcare Market. Innovations in sensor technology, connectivity, and data processing capabilities are enabling the development of more sophisticated healthcare applications. For instance, the emergence of 5G technology is expected to enhance the performance of IoT devices, allowing for faster data transmission and improved reliability. This is particularly important for applications that require real-time data analysis, such as telemedicine and remote surgery. Furthermore, the integration of artificial intelligence with IoT devices is likely to enhance predictive analytics, enabling healthcare providers to make more informed decisions. As these technologies continue to evolve, they are expected to drive further adoption of IoT solutions in healthcare, ultimately leading to improved patient care and operational efficiency.

Growing Focus on Preventive Healthcare

The Internet of Things (IoT) in Healthcare Market is increasingly influenced by a growing focus on preventive healthcare. This shift is characterized by a proactive approach to health management, where individuals and healthcare providers prioritize prevention over treatment. IoT devices, such as wearables and smart health monitors, facilitate this transition by providing real-time health data that can be used to identify potential health issues before they escalate. Market data indicates that the preventive healthcare segment is expected to witness substantial growth, driven by rising healthcare costs and a greater emphasis on wellness. By leveraging IoT technologies, healthcare systems can enhance their preventive care strategies, leading to better health outcomes and reduced healthcare expenditures. This trend underscores the importance of integrating IoT solutions into healthcare practices to foster a culture of prevention.

Regulatory Support and Standardization

Regulatory support and standardization are emerging as key drivers in the Internet of Things (IoT) in Healthcare Market. Governments and regulatory bodies are increasingly recognizing the potential of IoT technologies to improve healthcare delivery and patient outcomes. Initiatives aimed at establishing standards for data security, interoperability, and device certification are gaining traction. Such regulatory frameworks are essential for fostering trust among stakeholders and ensuring the safe deployment of IoT solutions in healthcare settings. Moreover, as regulations evolve, they are likely to encourage innovation and investment in IoT technologies. This supportive environment may lead to the development of new applications and services that enhance patient care. Consequently, the alignment of regulatory efforts with technological advancements is expected to play a pivotal role in shaping the future of IoT in healthcare.

Rising Demand for Remote Patient Monitoring

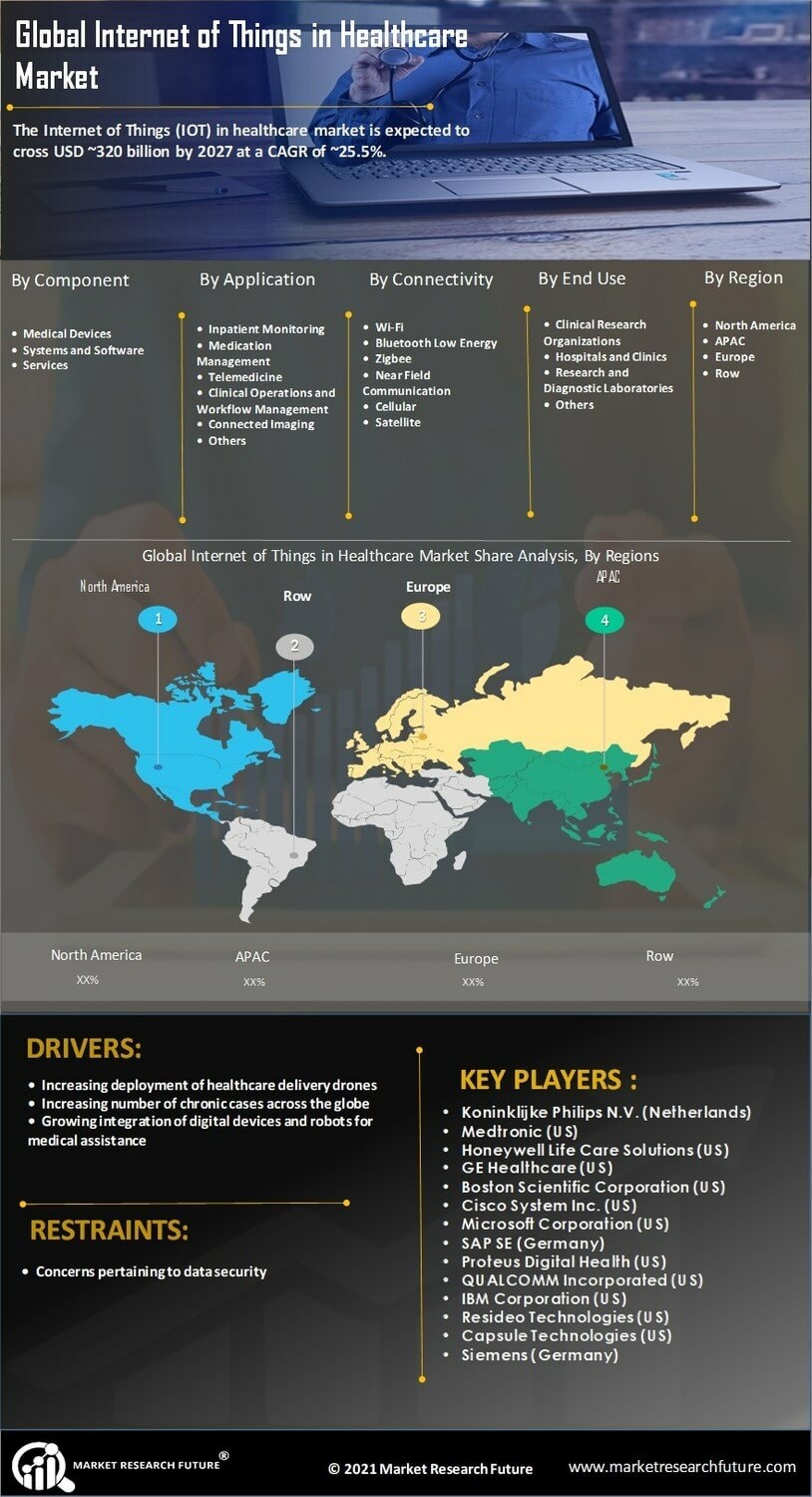

The Internet of Things (IoT) in Healthcare Market is witnessing a notable increase in the demand for remote patient monitoring solutions. This trend is driven by the need for continuous health monitoring, particularly for chronic disease management. According to recent data, the remote patient monitoring segment is projected to grow at a compound annual growth rate of over 25% in the coming years. This growth is largely attributed to the increasing prevalence of chronic diseases and the aging population, which necessitates innovative healthcare solutions. Remote monitoring devices enable healthcare providers to track patient health metrics in real-time, thereby enhancing patient engagement and improving health outcomes. As a result, the integration of IoT technologies into healthcare systems is becoming increasingly vital, as it allows for timely interventions and reduces the need for hospital visits.

Increased Investment in Healthcare Technology

Investment in healthcare technology is a significant driver of growth in the Internet of Things (IoT) in Healthcare Market. As healthcare organizations seek to enhance operational efficiency and improve patient care, they are increasingly allocating resources towards IoT solutions. Recent reports indicate that healthcare technology investments are projected to reach several billion dollars in the next few years, reflecting a strong commitment to digital transformation. This influx of capital is likely to accelerate the development and deployment of IoT devices and applications, ranging from smart medical equipment to advanced data analytics platforms. Furthermore, as healthcare providers recognize the value of data-driven decision-making, the demand for IoT solutions that facilitate real-time data collection and analysis is expected to rise. This trend underscores the critical role of investment in driving innovation and improving healthcare outcomes through IoT technologies.