Supportive Regulatory Environment

The homeopathic medicine market in Spain operates within a supportive regulatory environment that fosters growth and innovation. Regulatory bodies are increasingly recognizing the importance of homeopathic products, leading to clearer guidelines and standards for their use and distribution. This regulatory support not only enhances consumer confidence but also encourages manufacturers to invest in research and development. As a result, the market is likely to see an influx of new and improved homeopathic products, catering to the evolving needs of consumers. The establishment of a robust regulatory framework is expected to play a crucial role in the future expansion of the homeopathic medicine market.

Expansion of Distribution Channels

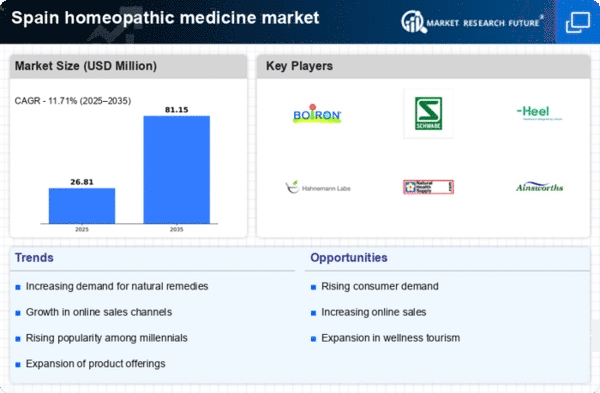

The homeopathic medicine market in Spain benefits from the expansion of distribution channels, which enhances accessibility for consumers. Pharmacies, health food stores, and online platforms are increasingly offering a diverse range of homeopathic products. This diversification in distribution not only caters to the growing demand but also facilitates consumer education regarding homeopathic options. Recent data indicates that online sales of homeopathic products have risen by 15% in the past year, reflecting a shift in purchasing behavior. As more consumers turn to e-commerce for their health needs, the homeopathic medicine market is likely to see further growth driven by improved accessibility.

Increasing Demand for Natural Remedies

The homeopathic medicine market in Spain experiences a notable increase in demand for natural remedies. This trend is driven by a growing consumer preference for holistic and alternative health solutions. Many individuals are becoming more aware of the potential side effects associated with conventional pharmaceuticals, leading them to seek safer, more natural alternatives. In recent years, the market has seen a surge, with estimates suggesting a growth rate of approximately 8% annually. This shift towards natural remedies is indicative of a broader societal movement towards wellness and preventive healthcare, which is likely to continue influencing the homeopathic medicine market in Spain.

Rising Interest in Preventive Healthcare

The homeopathic medicine market in Spain is significantly influenced by the rising interest in preventive healthcare. Consumers are increasingly prioritizing health maintenance and disease prevention over reactive treatments. This shift is reflected in the growing popularity of homeopathic remedies, which are often perceived as a proactive approach to health. Recent surveys indicate that approximately 60% of Spaniards are now considering alternative therapies as part of their wellness routines. This trend suggests a potential for sustained growth in the homeopathic medicine market, as more individuals seek to incorporate preventive measures into their healthcare practices.

Growing Integration of Homeopathy in Healthcare Systems

The homeopathic medicine market in Spain is witnessing a growing integration of homeopathy within conventional healthcare systems. This trend is characterized by an increasing number of healthcare professionals recognizing the benefits of homeopathic treatments and incorporating them into their practice. As more doctors and practitioners advocate for a holistic approach to health, the acceptance of homeopathy is likely to rise. Recent studies suggest that around 30% of healthcare providers in Spain now recommend homeopathic remedies to their patients. This integration not only legitimizes homeopathy but also expands its reach, potentially leading to increased market growth in the coming years.