Increasing Demand for Natural Remedies

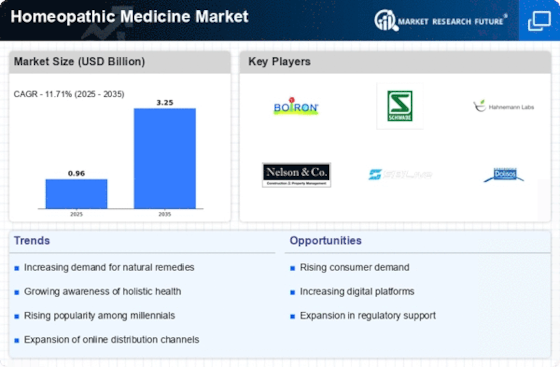

The Homeopathic Medicine Market is experiencing a notable surge in demand for natural remedies. Consumers are increasingly seeking alternatives to conventional pharmaceuticals, driven by a growing awareness of the potential side effects associated with synthetic drugs. This shift towards natural solutions is reflected in market data, indicating that the homeopathic segment is projected to grow at a compound annual growth rate of approximately 15% over the next five years. The inclination towards holistic health approaches, coupled with the rising prevalence of chronic diseases, further fuels this demand. As individuals become more health-conscious, the appeal of homeopathic treatments, which are perceived as safer and more gentle, continues to rise. This trend suggests a robust future for the Homeopathic Medicine Market, as it aligns with the broader movement towards wellness and preventive healthcare.

Regulatory Support and Standardization

The Homeopathic Medicine Market benefits from increasing regulatory support and standardization efforts. Governments and health authorities are recognizing the importance of regulating homeopathic products to ensure safety and efficacy. This regulatory framework not only enhances consumer confidence but also promotes the legitimacy of homeopathic practices. For instance, several countries have established guidelines for the manufacturing and labeling of homeopathic medicines, which helps to standardize quality across the industry. As a result, the market is likely to witness a more structured growth trajectory, with an anticipated increase in the number of licensed practitioners and certified products. This regulatory environment may also encourage investment in research and development, further solidifying the position of homeopathy within the broader healthcare landscape.

Growing Interest in Preventive Healthcare

The Homeopathic Medicine Market is witnessing a growing interest in preventive healthcare, as more individuals prioritize health maintenance over reactive treatment. This trend is largely driven by an increasing understanding of the benefits of preventive measures in avoiding chronic illnesses. Homeopathy, with its focus on treating the individual rather than just symptoms, aligns well with this preventive approach. Market Research Future indicates that consumers are more inclined to invest in homeopathic remedies as part of their wellness routines, which could lead to a substantial increase in market size. The emphasis on preventive healthcare is likely to encourage collaborations between homeopathic practitioners and conventional healthcare providers, further legitimizing homeopathy as a viable option for maintaining health. This shift towards prevention suggests a favorable outlook for the Homeopathic Medicine Market.

Rising Popularity of Holistic Health Practices

The Homeopathic Medicine Market is experiencing a rise in the popularity of holistic health practices, which emphasize the interconnectedness of the body, mind, and spirit. As consumers become more aware of the limitations of conventional medicine, there is a growing inclination towards holistic approaches that consider the whole person. This trend is reflected in the increasing number of wellness centers and clinics offering homeopathic treatments alongside other alternative therapies. Market data indicates that the holistic health market is expanding rapidly, with homeopathy playing a crucial role in this growth. The integration of homeopathic remedies into holistic health practices not only enhances treatment options but also attracts a diverse clientele seeking comprehensive care. This burgeoning interest in holistic health suggests a promising trajectory for the Homeopathic Medicine Market, as it aligns with contemporary consumer preferences.

Technological Advancements in Product Development

Technological advancements are playing a pivotal role in the evolution of the Homeopathic Medicine Market. Innovations in manufacturing processes, such as improved extraction techniques and quality control measures, are enhancing the efficacy and safety of homeopathic products. Additionally, the integration of digital technologies in product development is facilitating the creation of personalized homeopathic solutions tailored to individual patient needs. Market data suggests that the adoption of technology in homeopathy could lead to a significant increase in product offerings, thereby expanding market reach. Furthermore, the rise of telemedicine and online consultations is likely to enhance accessibility to homeopathic treatments, making them more appealing to a broader audience. This technological shift indicates a promising future for the Homeopathic Medicine Market, as it adapts to the evolving demands of consumers.