Growing Demand for Data Analytics

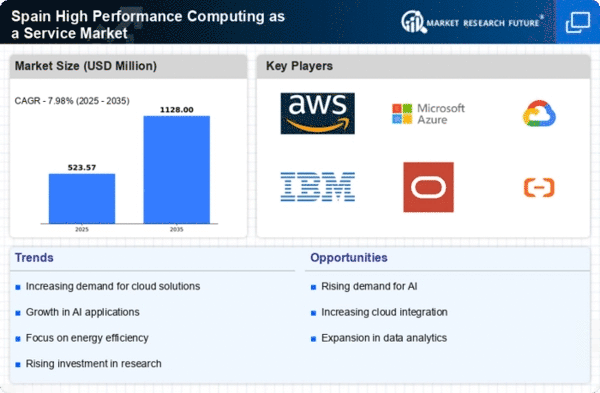

The The market in Spain is experiencing a surge in demand driven by the increasing need for advanced data analytics. is experiencing a surge in demand driven by the increasing need for advanced data analytics. Organizations across various sectors, including finance, healthcare, and telecommunications, are leveraging high-performance computing (HPC) to process vast amounts of data efficiently. This trend is reflected in the market's projected growth rate of approximately 15% annually, as businesses seek to gain insights from big data. The ability to perform complex simulations and analyses in real-time is becoming essential for maintaining competitive advantage. Consequently, the high performance-computing-as-a-service market is positioned to expand significantly as more enterprises recognize the value of data-driven decision-making.

Government Initiatives and Funding

Government initiatives aimed at promoting technological innovation are significantly impacting the The market in Spain is significantly impacted by government initiatives aimed at promoting technological innovation.. Various funding programs and grants are being introduced to support research and development in HPC technologies. For instance, the Spanish government has allocated over €100 million to enhance digital infrastructure, which includes investments in high-performance computing facilities. Such initiatives not only foster collaboration between public and private sectors but also stimulate growth in the high performance-computing-as-a-service market by providing the necessary resources for advancements in computing capabilities.

Collaboration with Academic Institutions

Collaboration between the high performance-computing-as-a-service market and academic institutions is fostering innovation and research advancements in Spain. Universities and research centers are increasingly partnering with HPC service providers to access cutting-edge computing resources for scientific research. This collaboration is expected to enhance the capabilities of the high performance-computing-as-a-service market, as academic institutions contribute to the development of new algorithms and applications. The synergy between academia and industry is likely to drive growth, with an anticipated increase of 12% in market participation from educational entities seeking to leverage HPC for research purposes.

Rising Need for Disaster Recovery Solutions

The increasing frequency of data breaches and system failures is driving the demand for robust disaster recovery solutions within the The market in Spain is driven by the increasing frequency of data breaches and system failures.. Organizations are recognizing the importance of having reliable backup systems to ensure business continuity. The market is projected to grow by 18% as companies seek to implement comprehensive disaster recovery strategies that leverage high-performance computing resources. This trend highlights the necessity for organizations to safeguard their data and maintain operational efficiency, thereby reinforcing the relevance of high performance-computing-as-a-service in contemporary business practices.

Support for Artificial Intelligence Applications

The integration of artificial intelligence (AI) into various business processes is propelling the The market in Spain is propelled by the integration of artificial intelligence (AI) into various business processes.. As organizations increasingly adopt AI technologies, the demand for powerful computing resources to train and deploy machine learning models is rising. The high performance-computing-as-a-service market is expected to grow by 20% in the next few years, as companies require scalable solutions to handle the computational demands of AI workloads. This trend indicates a shift towards more sophisticated computing environments that can support complex algorithms and large datasets, thereby enhancing the capabilities of AI applications across industries.