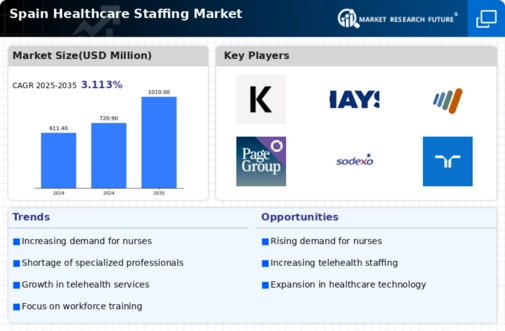

The Spain Healthcare Staffing Market is an evolving sector that reflects broader trends in employment, demographic changes, and healthcare demands across the country. This market has seen considerable growth, particularly in response to the increase in healthcare needs stemming from an aging population and the ongoing pressures on healthcare systems. As healthcare providers strive to maintain quality patient care while managing costs, healthcare staffing agencies have emerged as vital partners. Competitive insights reveal that agencies are leveraging technology and innovative staffing solutions to attract qualified personnel efficiently in a competitive landscape.

The market is characterized by a diversity of service providers, each vying for market share by presenting unique value propositions and tailoring their offerings to meet the specific needs of healthcare clients.In the Spain Healthcare Staffing Market, Nursing Agency has carved out a substantial niche through its strong reputation for providing qualified nursing professionals to hospitals, clinics, and private practices. The competitive strengths of Nursing Agency include a robust recruitment process that emphasizes rigorous vetting and training of healthcare professionals, ensuring that only the most skilled staff are assigned to clients.

Their deep understanding of local healthcare regulations and requirements further enhances their appeal to healthcare facilities seeking reliable staffing solutions. By focusing on personalized service and fostering long-term relationships with both clients and healthcare professionals, Nursing Agency effectively differentiates itself within a crowded market, creating a network of trusted partnerships that enhance patient care.Kelly Services has established a formidable presence in Spain’s healthcare staffing sector by offering a comprehensive range of services tailored to meet the diverse staffing needs of the industry.

The company provides not only nursing personnel but also administrative support and specialized healthcare professionals, allowing it to serve a broad spectrum of client needs. Kelly Services leverages its extensive global experience and local market knowledge to deliver tailored solutions that address the specific challenges faced by healthcare providers in Spain. The company has built its reputation on a platform of exceptional customer service and innovative staffing solutions, which include flexible staffing arrangements and recruitment process outsourcing.

In addition, Kelly Services has sought to expand its capabilities through strategic mergers and acquisitions in the healthcare sector, further enhancing its service offerings and market presence in Spain. This commitment to growth, combined with a keen understanding of client requirements, positions Kelly Services as a strong competitor in the Spain Healthcare Staffing Market, allowing it to adapt to the ever-changing dynamics of the healthcare industry.