Growing Focus on Patient-Centric Care

There is a discernible shift towards patient-centric care within the Spanish healthcare system, which is influencing the general surgical-devices market. Healthcare providers are increasingly prioritizing patient preferences and outcomes, leading to the development of surgical devices that cater to individual needs. This trend is reflected in the rising demand for customizable surgical solutions that enhance patient satisfaction. Additionally, the emphasis on shared decision-making between patients and healthcare professionals is fostering a more collaborative approach to surgical interventions. As patient-centric care continues to gain traction, the general surgical-devices market is expected to evolve, with manufacturers focusing on innovations that align with this paradigm shift.

Aging Population and Associated Health Issues

Spain's demographic landscape is characterized by an increasingly aging population, which is projected to reach 25% of the total population by 2030. This demographic shift is likely to drive the general surgical-devices market, as older individuals typically require more surgical interventions due to age-related health issues. The prevalence of chronic conditions such as cardiovascular diseases and orthopedic disorders is expected to rise, necessitating advanced surgical solutions. Consequently, healthcare providers are investing in innovative surgical devices to address the specific needs of this demographic, thereby expanding the market's potential. The intersection of an aging population and the demand for surgical interventions presents a compelling opportunity for growth in the general surgical-devices market.

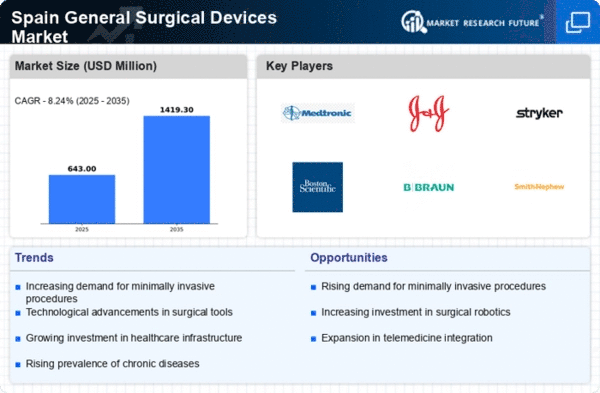

Rising Demand for Minimally Invasive Procedures

The general surgical-devices market in Spain is experiencing a notable increase in demand for minimally invasive surgical procedures. This trend is driven by the growing preference among patients for surgeries that promise reduced recovery times and lower risk of complications. According to recent data, minimally invasive techniques can lead to a 30% reduction in hospital stays, which is appealing to both patients and healthcare providers. As a result, manufacturers are focusing on developing advanced surgical devices that facilitate these procedures. The shift towards minimally invasive surgeries is likely to continue influencing the general surgical-devices market, as healthcare professionals seek to enhance patient outcomes while optimizing operational efficiency.

Technological Integration in Surgical Practices

The integration of advanced technologies such as robotics and artificial intelligence in surgical practices is reshaping the general surgical-devices market in Spain. Surgeons are increasingly adopting robotic-assisted surgeries, which enhance precision and reduce the likelihood of human error. Data indicates that robotic surgeries can improve patient outcomes by up to 20%, making them an attractive option for healthcare facilities. Furthermore, the incorporation of AI in surgical planning and execution is expected to streamline operations and improve efficiency. As these technologies become more prevalent, the general surgical-devices market is likely to witness significant growth, driven by the demand for innovative solutions that enhance surgical performance.

Government Initiatives to Enhance Healthcare Infrastructure

The Spanish government is actively investing in healthcare infrastructure, which is anticipated to positively impact the general surgical-devices market. Recent initiatives include funding for modernizing hospitals and expanding surgical facilities, aimed at improving access to quality healthcare services. The government has allocated approximately €1 billion for healthcare upgrades in the next fiscal year, which is expected to facilitate the acquisition of advanced surgical devices. This investment not only enhances the capabilities of healthcare providers but also encourages the adoption of new technologies in surgical practices. As a result, the general surgical-devices market is likely to benefit from these government efforts to bolster healthcare infrastructure.