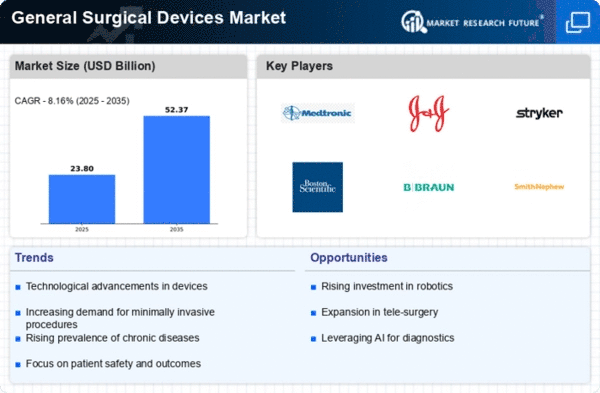

Market Growth Projections

The Global General Surgical Devices Market Industry is projected to experience substantial growth over the next decade. With a market value expected to reach 32.0 USD Billion by 2035, the industry is poised for significant expansion. The anticipated CAGR of 5.41% from 2025 to 2035 reflects the increasing demand for surgical devices driven by technological advancements and rising healthcare expenditures. This growth trajectory indicates a robust market environment, where innovation and investment are likely to flourish. The evolving landscape of surgical practices suggests that the industry will continue to adapt and thrive in response to changing healthcare needs.

Rising Surgical Procedures

The Global General Surgical Devices Market Industry experiences a notable increase in surgical procedures, driven by an aging population and the prevalence of chronic diseases. As healthcare systems evolve, the demand for surgical interventions rises, leading to a projected market value of 17.9 USD Billion in 2024. This growth is indicative of the increasing reliance on surgical solutions to address complex health issues. Furthermore, advancements in minimally invasive techniques are likely to enhance patient outcomes, thereby further propelling the market. The expansion of surgical facilities and the introduction of innovative devices are expected to support this upward trajectory.

Technological Advancements

Technological innovations play a pivotal role in shaping the Global General Surgical Devices Market Industry. The integration of robotics, artificial intelligence, and enhanced imaging technologies is transforming surgical practices, leading to improved precision and efficiency. These advancements not only enhance surgical outcomes but also reduce recovery times for patients. As a result, the market is anticipated to witness substantial growth, with projections indicating a rise to 32.0 USD Billion by 2035. The continuous development of smart surgical instruments and automated systems is likely to drive further investment in this sector, fostering a competitive landscape.

Regulatory Support and Standards

The Global General Surgical Devices Market Industry benefits from robust regulatory frameworks that ensure the safety and efficacy of surgical devices. Regulatory bodies are continuously updating standards to accommodate technological advancements and improve patient safety. This supportive environment encourages manufacturers to innovate and bring new products to market, thereby enhancing competition. Compliance with stringent regulations not only fosters consumer trust but also facilitates market entry for new players. As a result, the market is poised for growth, with an increasing number of devices receiving regulatory approval, which is likely to stimulate further investment in the sector.

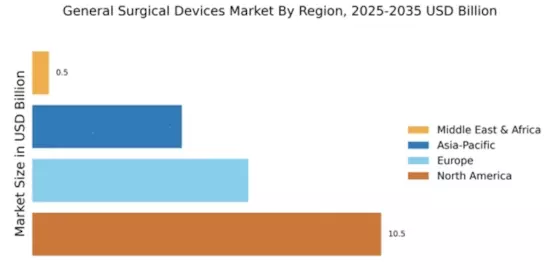

Increasing Healthcare Expenditure

The Global General Surgical Devices Market Industry is significantly influenced by rising healthcare expenditures across various regions. Governments and private sectors are investing heavily in healthcare infrastructure, which includes the procurement of advanced surgical devices. This trend is particularly evident in emerging economies, where healthcare reforms are underway to enhance service delivery. As a result, the market is expected to grow at a CAGR of 5.41% from 2025 to 2035. Increased funding for healthcare initiatives is likely to facilitate the adoption of innovative surgical technologies, thereby expanding the market's reach and accessibility.

Growing Awareness of Surgical Options

There is a growing awareness among patients regarding available surgical options, which is positively impacting the Global General Surgical Devices Market Industry. Educational campaigns and improved access to information are empowering patients to make informed decisions about their healthcare. This trend is leading to an increase in elective surgeries and minimally invasive procedures, as patients seek effective solutions for their health concerns. The market's expansion is further supported by the rising number of healthcare professionals advocating for surgical interventions. As patients become more proactive in their healthcare choices, the demand for general surgical devices is likely to rise.