Rising Healthcare Expenditure

The upward trend in healthcare expenditure in Spain is a significant driver for the gastritis treatment market. With the government and private sectors investing more in healthcare services, patients are gaining better access to diagnostic and treatment options for gastritis. In recent years, healthcare spending has increased by approximately 4% annually, reflecting a commitment to improving health outcomes. This financial support enables healthcare facilities to adopt advanced technologies and treatment modalities, enhancing the overall quality of care for gastritis patients. As healthcare expenditure continues to rise, the gastritis treatment market is likely to benefit from improved access to medications, specialist consultations, and comprehensive treatment plans, ultimately leading to better patient outcomes.

Growing Awareness of Gastritis

Public awareness regarding gastritis and its associated health implications is steadily increasing in Spain. Educational campaigns and healthcare initiatives are playing a pivotal role in informing the population about the symptoms and risks of gastritis. This heightened awareness is likely to lead to earlier diagnosis and treatment, thereby driving growth in the gastritis treatment market. As individuals become more informed about the importance of gastrointestinal health, they are more inclined to seek medical advice and treatment options. This trend is further supported by the increasing availability of information through digital platforms and healthcare providers. Consequently, the gastritis treatment market is poised for expansion as more patients recognize the need for effective management of their condition.

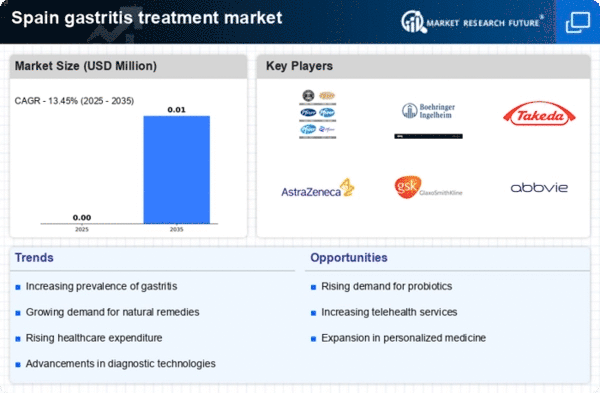

Increasing Prevalence of Gastritis

the rising incidence of gastritis in Spain is a crucial driver for the market.. Recent studies indicate that approximately 20% of the Spanish population experiences some form of gastritis, leading to a heightened demand for effective treatment options. This trend is likely influenced by dietary habits, stress levels, and the consumption of non-steroidal anti-inflammatory drugs (NSAIDs). As awareness of gastritis symptoms grows, patients are more inclined to seek medical advice, thereby propelling the gastritis treatment market forward. Healthcare providers are responding by expanding treatment protocols and offering a variety of therapeutic options, including medications and lifestyle modifications. This increasing prevalence not only underscores the need for effective treatments but also highlights the potential for market growth as more individuals are diagnosed and treated for gastritis.

Advancements in Pharmaceutical Research

Innovations in pharmaceutical research are significantly impacting the gastritis treatment market. The development of new medications, including proton pump inhibitors (PPIs) and H2-receptor antagonists, has transformed the management of gastritis. In Spain, the market for these medications is projected to grow at a CAGR of 5% over the next five years, driven by ongoing clinical trials and research initiatives. These advancements not only enhance treatment efficacy but also improve patient compliance and satisfaction. Furthermore, the introduction of combination therapies that target multiple pathways in gastritis management is likely to expand treatment options available to healthcare providers. As pharmaceutical companies invest in research and development, the market is expected to benefit from a broader range of effective therapies, catering to the diverse needs of patients.

Integration of Telemedicine in Treatment

The integration of telemedicine into healthcare services is emerging as a transformative factor in the gastritis treatment market. In Spain, the adoption of telehealth solutions has surged, particularly in the wake of increasing demand for accessible healthcare. Telemedicine allows patients to consult with healthcare professionals remotely, facilitating timely diagnosis and management of gastritis. This approach not only enhances patient convenience but also expands the reach of specialists to underserved areas. As telemedicine continues to gain traction, it is expected to play a crucial role in the gastritis treatment market by improving patient engagement and adherence to treatment plans. The potential for remote monitoring and follow-up care further underscores the value of telemedicine in managing gastritis effectively.