Rising Awareness and Education

Increased awareness and education regarding gastritis and its treatment options are pivotal drivers for the gastritis treatment market. Health campaigns and educational programs in Japan have been instrumental in informing the public about the symptoms and risks associated with gastritis. This heightened awareness encourages individuals to seek medical advice sooner, leading to earlier diagnosis and treatment. As a result, healthcare providers are witnessing a surge in consultations related to gastritis, which in turn stimulates demand for various treatment modalities. Furthermore, the integration of gastritis education into medical curricula ensures that healthcare professionals are well-equipped to manage this condition effectively. This trend suggests a positive outlook for the gastritis treatment market, as informed patients are more likely to pursue appropriate therapies.

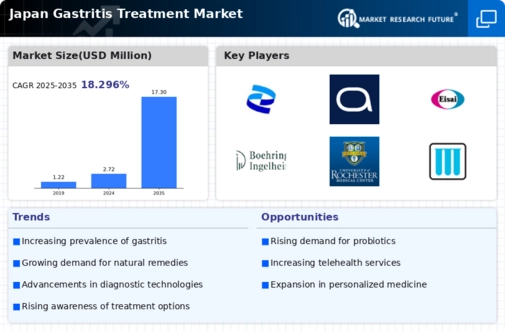

Increasing Prevalence of Gastritis

The rising incidence of gastritis in Japan is a crucial driver for the gastritis treatment market. Recent studies indicate that approximately 10-20% of the Japanese population experiences gastritis symptoms at some point in their lives. This growing prevalence is attributed to factors such as dietary habits, stress, and the high consumption of non-steroidal anti-inflammatory drugs (NSAIDs). As more individuals seek medical attention for gastritis-related issues, the demand for effective treatment options is likely to increase. Consequently, pharmaceutical companies are focusing on developing innovative therapies to address this health concern, thereby expanding the gastritis treatment market. Furthermore, the aging population in Japan, which is more susceptible to gastrointestinal disorders, further amplifies the need for targeted treatments, suggesting a robust growth trajectory for the gastritis treatment market in the coming years.

Impact of Dietary Habits on Gastritis

Dietary habits play a crucial role in the prevalence and management of gastritis, serving as a significant driver for the gastritis treatment market. In Japan, traditional diets rich in fiber and low in processed foods are associated with lower rates of gastritis. However, the increasing consumption of fast food and processed items has led to a rise in gastritis cases. This shift in dietary patterns necessitates effective treatment options to address the resulting health issues. Healthcare professionals are increasingly focusing on dietary counseling as part of gastritis management, which may include recommending specific foods to alleviate symptoms. Consequently, the gastritis treatment market is likely to benefit from this emphasis on dietary interventions, as patients seek comprehensive solutions that address both medical and lifestyle factors.

Advancements in Pharmaceutical Research

Innovations in pharmaceutical research are significantly impacting the gastritis treatment market. The development of new medications, including proton pump inhibitors (PPIs) and H2-receptor antagonists, has transformed the management of gastritis. These advancements not only enhance treatment efficacy but also improve patient compliance due to reduced side effects. In Japan, the market for PPIs alone is projected to reach approximately ¥200 billion by 2026, reflecting the growing reliance on advanced pharmacological solutions. Additionally, ongoing research into the role of gut microbiota in gastritis is opening new avenues for treatment, potentially leading to the introduction of novel therapies. As pharmaceutical companies invest in research and development, the gastritis treatment market is poised for substantial growth, driven by the introduction of innovative and effective treatment options.

Growing Preference for Non-Invasive Treatments

The gastritis treatment market is experiencing a shift towards non-invasive treatment options, which is becoming a significant driver. Patients in Japan increasingly prefer therapies that minimize discomfort and reduce recovery time. Non-invasive treatments, such as dietary modifications, lifestyle changes, and the use of over-the-counter medications, are gaining traction. This trend is supported by a growing body of evidence suggesting that lifestyle interventions can effectively manage gastritis symptoms. Moreover, the Japanese healthcare system is adapting to this preference by promoting non-invasive approaches, which are often more cost-effective. As a result, the gastritis treatment market is likely to expand as more patients opt for these less invasive solutions, reflecting a broader shift in patient expectations and healthcare delivery.