Rising E-Sports Popularity

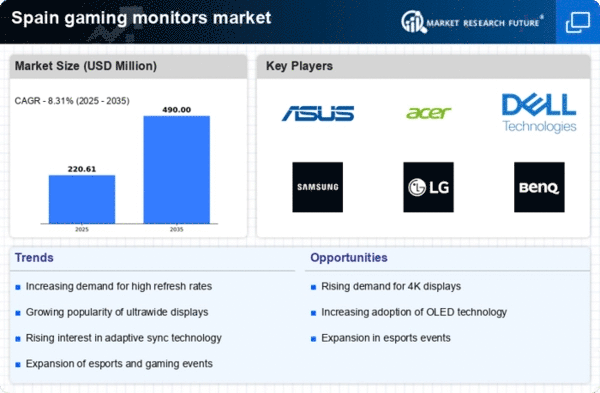

The increasing popularity of e-sports in Spain appears to be a significant driver for the gaming monitors market. As more individuals engage in competitive gaming, the demand for high-performance monitors rises. E-sports events attract large audiences, leading to a surge in interest among gamers who seek to enhance their gaming experience. This trend is reflected in the market data, which indicates that the e-sports sector is projected to grow at a CAGR of approximately 15% over the next few years. Consequently, the gaming monitors market is likely to benefit from this growth, as gamers invest in advanced displays to gain a competitive edge.

Growing Adoption of 4K Gaming Consoles

The growing adoption of 4K gaming consoles in Spain is driving demand for compatible gaming monitors. As major console manufacturers release new models capable of 4K output, gamers are seeking monitors that can fully utilize these capabilities. This shift is evident in the market, where sales of 4K monitors have increased significantly, with a reported growth rate of around 25% in the last year. is poised to capitalize on this trend., as consumers look for displays that offer high resolution and refresh rates to enhance their gaming experience.

Shift Towards Remote Gaming and Streaming

The shift towards remote gaming and streaming is reshaping the gaming monitors market in Spain. With more gamers engaging in online multiplayer experiences and streaming their gameplay, there is a growing need for monitors that deliver high performance and low latency. This trend is reflected in the increasing sales of monitors with features tailored for streaming, such as built-in webcams and high refresh rates. Market data indicates that the demand for monitors designed specifically for streaming has surged by approximately 40% in the past year. This shift suggests that the gaming monitors market will continue to evolve to meet the needs of this expanding consumer base.

Technological Advancements in Display Quality

Technological advancements in display quality are transforming the gaming monitors market. Innovations such as OLED and Mini-LED technologies provide superior color accuracy and contrast ratios, appealing to gamers who prioritize visual fidelity. In Spain, the market for high-resolution monitors, particularly those offering 4K and 1440p resolutions, is expanding rapidly. Recent data suggests that the segment for monitors with refresh rates exceeding 144Hz is experiencing a growth rate of around 20% annually. This trend indicates that consumers are increasingly willing to invest in premium gaming monitors that enhance their overall gaming experience.

Increased Consumer Spending on Gaming Equipment

In Spain, there is a noticeable increase in consumer spending on gaming equipment, which is positively impacting the gaming monitors market. As disposable incomes rise, gamers are more inclined to invest in high-quality monitors that offer enhanced features. Market analysis shows that the average spending on gaming peripherals, including monitors, has risen by approximately 30% in recent years. This trend suggests that consumers are prioritizing their gaming setups, leading to a higher demand for advanced gaming monitors that provide immersive experiences. is likely to continue benefiting from this upward trend in consumer expenditure..