Rising Healthcare Expenditure

The increasing healthcare expenditure in Spain is a pivotal driver for the extremity products market. As the government allocates more funds towards healthcare, the demand for advanced medical devices, including extremity products, is likely to rise. In 2025, healthcare spending in Spain is projected to reach approximately €200 billion, reflecting a growth of around 5% from previous years. This financial commitment enables hospitals and clinics to invest in innovative extremity products, enhancing patient care and recovery outcomes. Furthermore, the emphasis on improving healthcare infrastructure supports the adoption of these products, as healthcare providers seek to offer the latest solutions to their patients. Consequently, the rising healthcare expenditure is expected to significantly bolster the extremity products market in Spain.

Increased Sports Participation

The growing trend of sports participation among the Spanish population is contributing to the expansion of the extremity products market. With more individuals engaging in various sports activities, the incidence of sports-related injuries is likely to increase, thereby driving the demand for extremity products. In recent years, it has been observed that approximately 30% of the population participates in sports regularly, leading to a heightened need for effective injury management solutions. This trend is further supported by government initiatives promoting physical activity and wellness. As a result, the extremity products market is poised to benefit from the rising number of sports injuries, as athletes and active individuals seek advanced products for recovery and rehabilitation.

Demographic Shifts and Urbanization

Demographic shifts and urbanization in Spain are influencing the extremity products market in various ways. The movement of populations towards urban areas is associated with lifestyle changes that may lead to an increase in musculoskeletal disorders. As urban living often entails a more sedentary lifestyle, the demand for extremity products to address these health issues is likely to rise. Additionally, the urban population is generally more aware of healthcare options, which may drive the adoption of extremity products. By 2025, it is anticipated that urban areas will house over 80% of the Spanish population, creating a substantial market for extremity products as individuals seek solutions for their health concerns.

Growing Awareness of Orthopedic Solutions

There is a notable increase in awareness regarding orthopedic solutions among the Spanish population, which is positively influencing the extremity products market. Educational campaigns and healthcare initiatives have played a crucial role in informing individuals about the benefits of using orthopedic products for injury prevention and recovery. As a result, more patients are seeking specialized extremity products to address their needs. In 2025, it is estimated that the orthopedic segment of the extremity products market will account for approximately 40% of total sales in Spain. This growing awareness is likely to drive innovation and product development, as manufacturers respond to the demand for more effective and user-friendly solutions.

Technological Innovations in Product Design

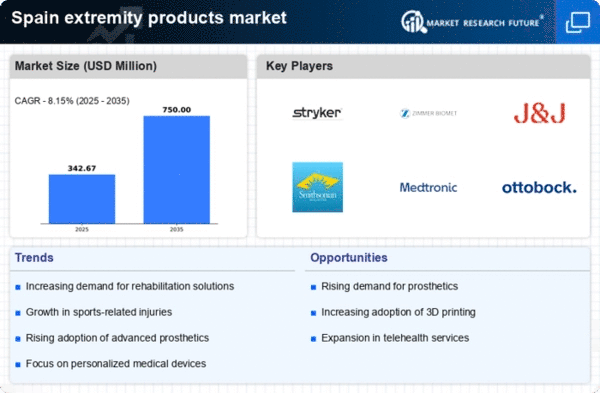

Technological innovations in product design are transforming the extremity products market, leading to enhanced functionality and user experience. Manufacturers are increasingly integrating advanced materials and smart technologies into their products, which may improve performance and comfort for users. For instance, the introduction of lightweight materials and 3D printing techniques has enabled the production of customized extremity products that cater to individual patient needs. This trend is expected to continue, with the market projected to grow at a CAGR of 6% over the next five years. As these innovations become more prevalent, healthcare providers in Spain are likely to adopt these advanced solutions, further propelling the extremity products market.