Increased Healthcare Expenditure

Japan's healthcare expenditure has been on the rise, reflecting the government's commitment to improving health services and access to medical products. In 2025, healthcare spending is expected to reach approximately ¥42 trillion, which translates to a significant investment in medical technologies, including those related to the extremity products market. This increase in funding is likely to facilitate better access to advanced extremity products for patients, particularly in rehabilitation and post-surgical recovery. As healthcare providers adopt more innovative solutions to enhance patient care, the demand for high-quality extremity products is expected to grow. This trend indicates a positive outlook for manufacturers and suppliers within the extremity products market, as they align their offerings with the evolving needs of healthcare professionals and patients.

Advancements in Medical Technology

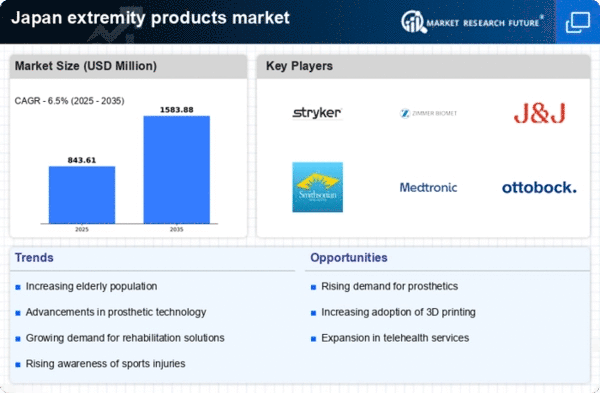

The extremity products market is significantly influenced by advancements in medical technology, particularly in the development of orthopedic devices and surgical techniques. Innovations such as 3D printing and smart materials are revolutionizing the design and functionality of extremity products, making them more effective and user-friendly. For instance, custom-fitted braces and prosthetics are becoming more accessible, allowing for better patient outcomes. The Japanese government has been actively promoting research and development in the healthcare sector, which is likely to enhance the competitiveness of the extremity products market. As a result, the market is projected to grow at a CAGR of around 5% over the next five years, driven by these technological advancements that improve patient care and recovery times.

Rising Incidence of Sports Injuries

Increased participation in sports and physical activities in Japan has led to a rise in sports-related injuries. This trend is particularly evident among younger demographics, where the extremity products market is experiencing heightened demand for braces, supports, and other protective gear. According to recent data, sports injuries account for approximately 30% of all injuries reported in the country. As athletes seek to recover and prevent further injuries, the extremity products market is likely to expand, driven by innovations in product design and materials that enhance performance and safety. Furthermore, the growing awareness of injury prevention strategies among coaches and trainers is expected to further bolster the market, as they increasingly recommend the use of specialized extremity products to their athletes.

Growing Awareness of Preventive Healthcare

There is a noticeable shift towards preventive healthcare in Japan, with individuals increasingly prioritizing health and wellness. This cultural change is influencing the extremity products market, as consumers seek products that not only aid in recovery but also prevent injuries. The rise of fitness trends and wellness programs has led to a greater emphasis on maintaining physical health, which in turn drives demand for supportive and protective extremity products. Market Research Future suggests that around 40% of consumers are now more inclined to invest in preventive solutions, such as compression sleeves and ankle supports. This growing awareness is likely to create new opportunities for manufacturers to innovate and market their products effectively, thereby expanding the extremity products market.

Regulatory Support for Innovative Products

The regulatory environment in Japan is becoming increasingly supportive of innovation in the extremity products market. The Pharmaceuticals and Medical Devices Agency (PMDA) has streamlined approval processes for new medical devices, encouraging companies to bring innovative extremity products to market more quickly. This regulatory support is crucial for fostering competition and enhancing product offerings, as it allows manufacturers to respond swiftly to market demands. As a result, the extremity products market is likely to see a surge in new entrants and product launches, which could lead to a broader range of options for consumers. Furthermore, this supportive regulatory framework may also attract foreign investment, further stimulating growth within the extremity products market.