Growing Consumer Demand

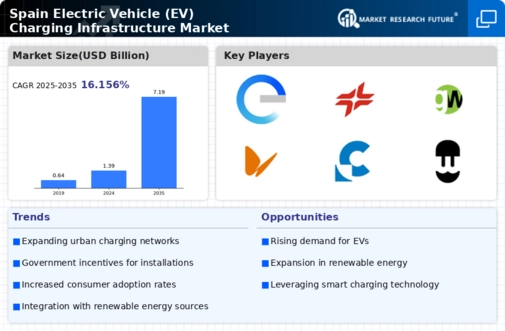

The increasing consumer demand for electric vehicles is a pivotal driver for the Spain electric vehicle charging infrastructure market. As awareness of environmental issues rises, more consumers are considering electric vehicles as a viable alternative to traditional combustion engine cars. In 2025, electric vehicle sales in Spain accounted for approximately 10% of total vehicle sales, indicating a growing trend towards electrification. This surge in demand necessitates the expansion of charging infrastructure to ensure that consumers have convenient access to charging points. The presence of a well-developed charging network is likely to influence purchasing decisions, as potential buyers often consider the availability of charging options when evaluating electric vehicles.

Technological Innovations

Technological advancements play a crucial role in shaping the Spain electric vehicle charging infrastructure market. The emergence of fast-charging technologies, such as ultra-fast chargers, has the potential to significantly reduce charging times, making electric vehicles more appealing to consumers. As of January 2026, Spain has seen a rise in the deployment of high-power charging stations, which can deliver up to 350 kW of power. This development is likely to enhance the convenience of electric vehicle ownership, as drivers can recharge their vehicles in a matter of minutes rather than hours. Additionally, the integration of smart charging solutions, which optimize energy consumption based on grid demand, is expected to further improve the efficiency of the charging infrastructure.

Government Incentives and Policies

The Spain electric vehicle charging infrastructure market is significantly influenced by government incentives and policies aimed at promoting electric vehicle adoption. The Spanish government has implemented various initiatives, including subsidies for electric vehicle purchases and grants for the installation of charging stations. For instance, the Plan Moves III, launched in 2021, allocated 400 million euros to support the deployment of charging infrastructure. This financial backing is expected to enhance the accessibility of charging points across urban and rural areas, thereby encouraging consumers to transition to electric vehicles. Furthermore, the Spanish government has set ambitious targets to have 5 million electric vehicles on the road by 2030, which necessitates a robust charging network to support this growth.

Urbanization and Infrastructure Development

Urbanization trends in Spain are contributing to the growth of the electric vehicle charging infrastructure market. As cities expand and populations increase, the demand for efficient transportation solutions becomes more pressing. Urban areas are increasingly adopting electric vehicles as part of their public transport systems, which in turn drives the need for a comprehensive charging network. Local governments are investing in the installation of charging stations in public spaces, such as parking lots and along major roadways, to accommodate this shift. By 2026, it is anticipated that urban centers will have significantly increased the number of public charging points, thereby facilitating the transition to electric mobility and supporting the overall infrastructure development.

Environmental Regulations and Sustainability Goals

The Spain electric vehicle charging infrastructure market is also shaped by stringent environmental regulations and sustainability goals set by both the European Union and the Spanish government. These regulations aim to reduce greenhouse gas emissions and promote sustainable transportation solutions. Spain has committed to achieving carbon neutrality by 2050, which necessitates a substantial increase in electric vehicle adoption and, consequently, the expansion of charging infrastructure. The government has established specific targets for reducing emissions from the transport sector, which include increasing the number of electric vehicles on the road and enhancing the availability of charging stations. This regulatory framework is likely to drive investments in the charging infrastructure, as stakeholders seek to comply with these ambitious sustainability objectives.