Government Incentives and Policies

The UK electric vehicle charging infrastructure market is significantly influenced by government incentives and policies aimed at promoting electric vehicle adoption. The UK government has committed to achieving net-zero carbon emissions by 2050, which includes substantial investments in charging infrastructure. For instance, the On-Street Residential Chargepoint Scheme provides funding for local authorities to install charging points. Additionally, the UK government has allocated over 1.3 billion GBP to support the rollout of electric vehicle charging infrastructure, which is expected to enhance the accessibility and convenience of charging options for consumers. This proactive approach not only encourages the transition to electric vehicles but also stimulates growth within the UK electric vehicle charging infrastructure market.

Corporate Sustainability Initiatives

Corporate sustainability initiatives are increasingly influencing the UK electric vehicle charging infrastructure market. Many companies are adopting electric vehicle fleets as part of their commitment to reducing carbon footprints. This shift is prompting businesses to invest in their own charging infrastructure, thereby expanding the overall network. For instance, major corporations are installing charging stations at their facilities to support their employees and customers who drive electric vehicles. This trend not only enhances the visibility of charging options but also contributes to the overall growth of the UK electric vehicle charging infrastructure market. As more companies recognize the importance of sustainability, the demand for charging infrastructure is expected to rise.

Public Awareness and Education Campaigns

Public awareness and education campaigns are essential drivers of the UK electric vehicle charging infrastructure market. As consumers become more informed about the benefits of electric vehicles and the availability of charging options, their willingness to adopt EVs increases. Government and non-profit organizations are actively promoting the advantages of electric vehicles, including lower running costs and reduced emissions. These campaigns aim to demystify the charging process and highlight the expanding network of charging stations across the UK. As awareness grows, it is anticipated that more individuals will transition to electric vehicles, thereby driving demand for a comprehensive charging infrastructure. This increased consumer engagement is likely to bolster the UK electric vehicle charging infrastructure market.

Rising Consumer Demand for Electric Vehicles

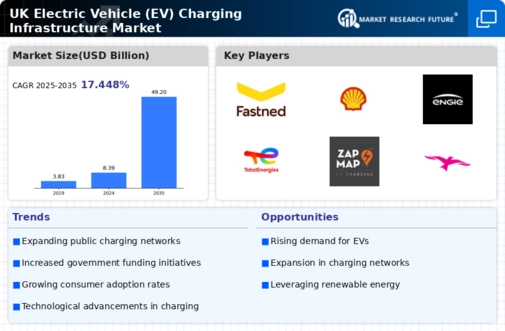

Consumer demand for electric vehicles (EVs) is on the rise in the UK, which is a crucial driver for the electric vehicle charging infrastructure market. As of January 2026, the UK has seen a significant increase in EV registrations, with over 400,000 new electric vehicles registered in 2025 alone. This surge in demand necessitates a corresponding expansion of charging infrastructure to accommodate the growing number of EVs on the road. The increasing awareness of environmental issues and the desire for sustainable transportation options further fuel this demand. Consequently, the UK electric vehicle charging infrastructure market must adapt to meet the needs of an expanding EV user base, ensuring that charging points are readily available and accessible.

Technological Advancements in Charging Solutions

Technological advancements play a pivotal role in shaping the UK electric vehicle charging infrastructure market. Innovations such as ultra-fast charging stations and wireless charging technology are enhancing the efficiency and convenience of charging electric vehicles. For example, ultra-fast chargers can deliver up to 350 kW of power, allowing EVs to charge significantly faster than traditional chargers. This technological evolution not only improves the user experience but also encourages more consumers to consider electric vehicles as a viable option. As these technologies continue to develop, they are likely to attract further investment and interest in the UK electric vehicle charging infrastructure market, ultimately leading to a more robust and efficient charging network.