Government Initiatives and Funding

The Spain disposable endoscope market industry is positively influenced by government initiatives and funding aimed at improving healthcare infrastructure. The Spanish government has allocated significant resources to enhance medical facilities and promote the adoption of advanced medical technologies, including disposable endoscopes. In 2025, public health expenditure in Spain is expected to increase by 5%, with a portion dedicated to acquiring innovative medical devices. This financial support encourages hospitals to invest in disposable endoscopes, which are often more cost-effective in the long run due to reduced reprocessing costs. Additionally, government campaigns promoting the importance of infection control and patient safety further bolster the market. As a result, the disposable endoscope market in Spain is likely to benefit from ongoing governmental support and investment.

Growing Awareness of Patient Safety

The Spain disposable endoscope market industry is experiencing a heightened awareness of patient safety, which is driving the adoption of disposable endoscopes. Healthcare providers are increasingly recognizing the importance of minimizing risks associated with reusable devices, particularly in light of recent studies highlighting the potential for infection transmission. In 2025, surveys indicate that over 70% of healthcare professionals in Spain prioritize patient safety when selecting medical devices, leading to a shift towards single-use endoscopes. This growing emphasis on safety is further supported by patient advocacy groups that promote the use of disposable devices to enhance overall care quality. Consequently, the disposable endoscope market in Spain is likely to expand as healthcare facilities align their practices with the evolving standards of patient safety.

Increased Focus on Infection Control

The Spain disposable endoscope market industry is experiencing a notable shift towards enhanced infection control measures. Hospitals and healthcare facilities are increasingly adopting disposable endoscopes to mitigate the risk of cross-contamination and healthcare-associated infections. This trend is driven by stringent regulations and guidelines from health authorities, emphasizing the need for safer medical practices. In 2025, the Spanish healthcare system reported a 15% increase in the adoption of disposable endoscopes, reflecting a growing awareness of infection control. Furthermore, the COVID-19 pandemic has accelerated the demand for single-use devices, as they eliminate the need for reprocessing and sterilization. As a result, the disposable endoscope market in Spain is likely to continue expanding, driven by the imperative to enhance patient safety and reduce infection rates.

Technological Advancements in Device Design

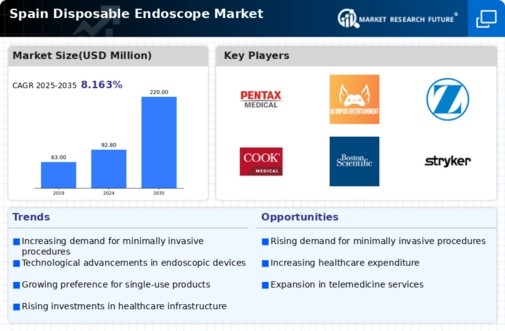

The Spain disposable endoscope market industry is benefiting from rapid technological advancements in device design, which enhance the functionality and performance of disposable endoscopes. Innovations such as improved imaging capabilities, flexible designs, and integrated features are making these devices more appealing to healthcare providers. In 2025, the market for advanced disposable endoscopes in Spain is projected to grow by 20%, driven by the introduction of next-generation devices that offer superior visualization and ease of use. These advancements not only improve diagnostic accuracy but also facilitate a wider range of procedures, thereby expanding the market's potential. As manufacturers continue to invest in research and development, the disposable endoscope market in Spain is likely to see further growth, fueled by the demand for cutting-edge medical technology.

Rising Demand for Minimally Invasive Procedures

The Spain disposable endoscope market industry is witnessing a surge in demand for minimally invasive procedures, which are favored for their reduced recovery times and lower complication rates. As healthcare providers increasingly prioritize patient-centric approaches, the use of disposable endoscopes has become more prevalent in various diagnostic and therapeutic applications. In 2025, approximately 60% of gastrointestinal procedures in Spain utilized disposable endoscopes, indicating a significant shift in procedural preferences. This trend is further supported by advancements in endoscopic technology, which enhance the efficacy and safety of these procedures. The growing acceptance of minimally invasive techniques among both patients and healthcare professionals suggests that the disposable endoscope market in Spain will continue to thrive, driven by the desire for improved patient outcomes and satisfaction.