Growing Remote Work Culture

The growing remote work culture significantly influences the digital paper-system market in Spain. As more companies embrace flexible work arrangements, the need for efficient digital document management systems becomes paramount. In 2025, it is anticipated that the demand for digital paper solutions will rise by approximately 25% due to the increasing reliance on remote collaboration tools. This shift necessitates the adoption of digital systems that facilitate seamless access to documents and enhance communication among remote teams. Consequently, the digital paper-system market is likely to expand as organizations adapt to this evolving work environment.

Increased Focus on Cost Efficiency

Cost efficiency remains a driving factor in the digital paper-system market in Spain. Organizations are continuously seeking ways to reduce operational costs, and transitioning to digital paper systems presents a viable solution. By minimizing paper usage and associated printing costs, businesses can achieve substantial savings. Reports indicate that companies can save up to 30% on document management expenses by adopting digital solutions. This financial incentive is likely to propel the growth of the digital paper-system market, as more organizations recognize the long-term benefits of investing in digital alternatives.

Regulatory Compliance and Data Security

Regulatory compliance and data security are critical considerations for businesses in Spain, impacting the digital paper-system market. With stringent regulations surrounding data protection, organizations are compelled to adopt digital solutions that ensure compliance while safeguarding sensitive information. In 2025, it is expected that the market will grow by 18% as companies prioritize secure digital document management systems. This focus on compliance not only mitigates risks but also enhances operational efficiency, making digital paper systems an attractive option for businesses aiming to navigate the complexities of regulatory requirements.

Rising Demand for Eco-Friendly Solutions

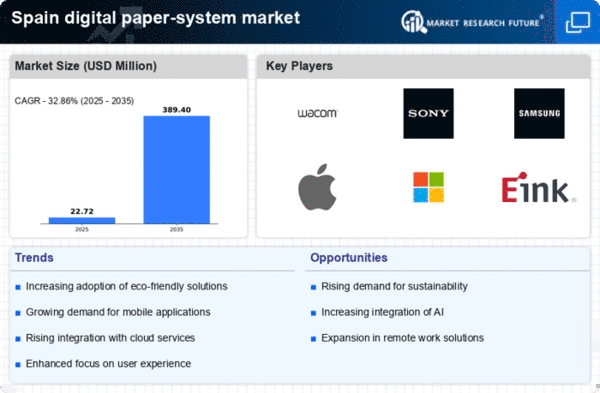

the digital paper-system market in Spain is experiencing a notable increase in demand for eco-friendly solutions.. As businesses and consumers become more environmentally conscious, the shift towards digital alternatives to traditional paper products is evident. In 2025, it is estimated that the market for digital paper systems will grow by approximately 15%, driven by the need to reduce paper waste and carbon footprints. This trend aligns with Spain's commitment to sustainability, as the government promotes initiatives aimed at reducing environmental impact. Consequently, companies that offer digital paper solutions are likely to benefit from this heightened awareness and demand, positioning themselves favorably within the digital paper-system market.

Technological Advancements in Digital Solutions

Technological advancements play a crucial role in shaping the digital paper-system market in Spain. Innovations such as cloud computing, artificial intelligence, and machine learning are enhancing the functionality and efficiency of digital paper systems. In 2025, the integration of these technologies is projected to increase market growth by around 20%. Businesses are increasingly adopting these advanced solutions to streamline operations, improve collaboration, and enhance productivity. As a result, the digital paper-system market is likely to witness a surge in adoption rates, as organizations seek to leverage technology to optimize their document management processes.