Rising Cybersecurity Concerns

Rising cybersecurity concerns are significantly influencing the digital paper-system market in Canada. As organizations increasingly digitize their operations, the potential risks associated with data breaches and cyber threats have come to the forefront. This has prompted businesses to seek robust digital paper systems that offer enhanced security features. The digital paper-system market is responding to this demand by integrating advanced security protocols, such as encryption and multi-factor authentication, into their offerings. According to recent surveys, over 60% of Canadian companies express heightened concern regarding data security, which is likely to drive the adoption of secure digital solutions. As organizations prioritize the protection of sensitive information, the market is expected to grow, reflecting the critical need for secure digital paper systems.

Support from Government Initiatives

Support from government initiatives is playing a pivotal role in the growth of the digital paper-system market in Canada. Various federal and provincial programs are being implemented to encourage the adoption of digital technologies across multiple sectors. These initiatives often include funding, grants, and resources aimed at facilitating the transition to digital solutions. The digital paper-system market is likely to benefit from such support, as it aligns with governmental objectives to enhance efficiency and reduce environmental impact. Furthermore, policies promoting digital literacy and technology adoption are expected to create a favorable environment for market expansion. As government backing continues, the market may see increased participation from businesses eager to leverage digital paper systems for improved operational effectiveness.

Growing Demand for Eco-Friendly Solutions

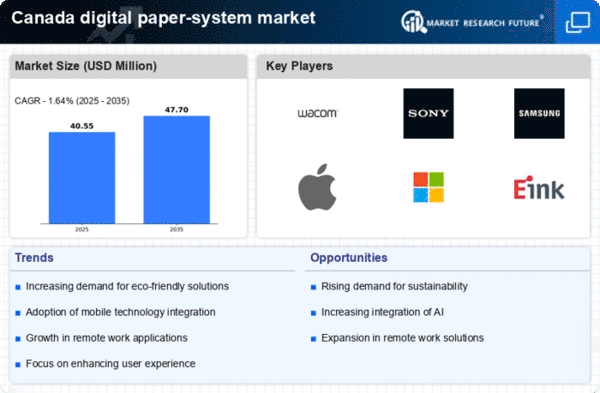

The digital paper-system market in Canada is experiencing a notable increase in demand for eco-friendly solutions. As organizations strive to reduce their carbon footprint, the shift towards digital alternatives is becoming more pronounced. This trend is driven by heightened awareness of environmental issues among consumers and businesses alike. In fact, a significant % of Canadian companies are actively seeking to implement sustainable practices, which includes transitioning to digital paper systems. The market is projected to grow as more entities recognize the benefits of reducing paper usage, which not only conserves resources but also lowers operational costs. The digital paper-system market is thus positioned to capitalize on this growing demand, as it aligns with the broader sustainability goals of various sectors, including education, healthcare, and corporate environments.

Shift Towards Remote Work and Collaboration

The shift towards remote work and collaboration is reshaping the landscape of the digital paper-system market in Canada. As more organizations adopt flexible work arrangements, the need for efficient digital solutions has become paramount. This transition has led to an increased reliance on digital paper systems, which facilitate seamless collaboration among remote teams. The digital paper-system market is witnessing a surge in demand for tools that enable document sharing, editing, and storage in a virtual environment. Furthermore, studies suggest that companies utilizing digital solutions experience a 30% increase in productivity, underscoring the value of these systems in a remote work context. As remote work continues to be a prevalent model, the market is likely to expand, driven by the necessity for effective digital communication and collaboration tools.

Increased Investment in Digital Infrastructure

Investment in digital infrastructure is a critical driver for the digital paper-system market in Canada. As businesses and government entities prioritize digital transformation, funding for advanced technologies is on the rise. Reports indicate that Canadian organizations are allocating substantial budgets towards enhancing their digital capabilities, with a projected increase of over 20% in IT spending in the coming years. This investment is likely to facilitate the adoption of digital paper systems, which offer improved efficiency and accessibility. The digital paper-system market stands to benefit from this trend, as organizations seek to streamline operations and reduce reliance on traditional paper-based processes. Enhanced digital infrastructure not only supports the implementation of these systems but also fosters innovation, enabling companies to explore new functionalities and applications.