Rising Data Consumption

The data center-rack market in Spain experiences a notable surge in demand due to the increasing consumption of data across various sectors. With the proliferation of digital services, businesses are generating vast amounts of data, necessitating efficient storage solutions. Reports indicate that data traffic in Spain is expected to grow by approximately 30% annually, driving the need for more robust data center infrastructure. This trend compels organizations to invest in advanced data center-rack systems that can accommodate higher data loads while ensuring optimal performance. Consequently, the data center-rack market is poised for growth as companies seek to enhance their data management capabilities to meet the escalating demands of consumers and businesses alike.

Emergence of Edge Computing

The rise of edge computing is reshaping the data center-rack market landscape in Spain. As businesses seek to process data closer to the source, the demand for localized data centers increases. This trend necessitates the deployment of compact and efficient data center-rack solutions that can accommodate edge computing requirements. The market is witnessing a shift towards smaller, modular racks that can be easily integrated into various environments. Consequently, the data center-rack market is adapting to these changes, focusing on innovative designs that cater to the unique needs of edge computing applications. This evolution presents opportunities for manufacturers to develop specialized products that align with the growing demand for decentralized data processing.

Increased Focus on Data Security

Data security concerns are becoming increasingly paramount for organizations in Spain, driving investments in the data center-rack market. As cyber threats evolve, businesses are compelled to enhance their data protection measures, which includes upgrading their data center infrastructure. The data center-rack market is responding to this need by offering solutions that incorporate advanced security features, such as biometric access controls and enhanced monitoring systems. Reports indicate that organizations are willing to allocate up to 15% of their IT budgets towards improving data security, further fueling the demand for secure data center-rack systems. This focus on security not only protects sensitive information but also fosters trust among consumers, thereby contributing to the overall growth of the market.

Growth of Cloud Computing Services

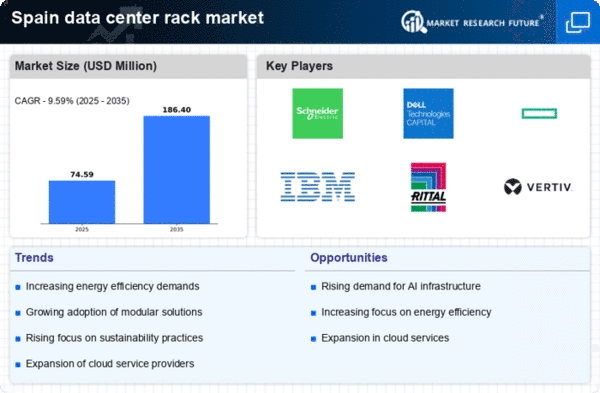

The expansion of cloud computing services in Spain is a critical driver for the data center-rack market. As businesses increasingly migrate to cloud-based solutions, the demand for scalable and efficient data center infrastructure rises. Reports suggest that the cloud services market in Spain is projected to grow by over 25% in the coming years, necessitating the deployment of advanced data center-rack systems. This growth compels service providers to invest in high-density racks that can support virtualized environments and optimize resource utilization. Thus, the data center-rack market stands to benefit significantly from the ongoing shift towards cloud computing, as organizations seek to enhance their IT capabilities.

Government Initiatives for Digital Transformation

The Spanish government actively promotes digital transformation initiatives, which significantly impact the data center-rack market. Policies aimed at enhancing digital infrastructure and fostering innovation create a favorable environment for data center investments. For instance, the government has allocated substantial funding to support technology adoption in various sectors, which indirectly boosts the demand for data center-rack solutions. As organizations align with these initiatives, the data center-rack market is likely to witness increased investments in modern infrastructure. This alignment not only enhances operational efficiency but also positions Spain as a competitive player in the European digital landscape.