Growth of Edge Computing

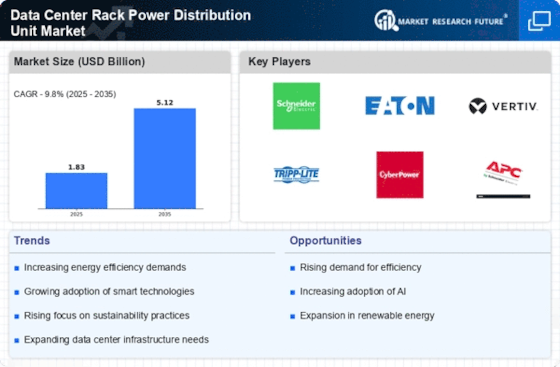

The rise of edge computing is reshaping the landscape of data processing and storage, leading to new demands in the Data Center Rack Power Distribution Unit Market. As more data is processed closer to the source, the need for localized data centers and micro data centers is increasing. This shift necessitates power distribution solutions that can efficiently manage power in smaller, decentralized environments. Market analysis indicates that the edge computing segment is expected to grow at a compound annual growth rate of over 25% in the coming years. This growth presents opportunities for power distribution units that are specifically designed for edge applications, thereby expanding the market further.

Emphasis on Energy Management

Energy efficiency has become a critical focus for data center operators, prompting a shift towards advanced power distribution solutions. The Data Center Rack Power Distribution Unit Market is experiencing growth as companies seek to reduce operational costs and minimize their carbon footprint. Recent data indicates that energy consumption in data centers accounts for a significant portion of total energy use, with estimates suggesting that this could reach 3% of global electricity demand by 2030. Consequently, power distribution units that offer energy monitoring and management capabilities are increasingly sought after. This trend not only enhances operational efficiency but also aligns with regulatory pressures for sustainability, further driving market growth.

Rising Demand for Data Centers

The increasing reliance on digital services and cloud computing has led to a surge in the establishment of data centers. This trend is expected to drive the Data Center Rack Power Distribution Unit Market as operators seek efficient power distribution solutions to manage their growing infrastructure. According to recent estimates, the number of data centers is projected to grow by approximately 20% over the next five years. This expansion necessitates advanced power distribution units that can handle higher loads and provide reliable power management. As data centers evolve to accommodate more servers and storage devices, the demand for sophisticated power distribution solutions will likely intensify, thereby propelling the market forward.

Regulatory Compliance and Standards

As data centers face increasing scrutiny regarding energy consumption and environmental impact, compliance with regulatory standards is becoming essential. The Data Center Rack Power Distribution Unit Market is influenced by these regulations, which often mandate specific energy efficiency benchmarks. Compliance with such standards can lead to increased operational costs if not managed properly, thus driving the demand for efficient power distribution solutions. Recent regulations have been introduced that require data centers to report their energy usage and implement measures to reduce waste. This regulatory landscape is likely to propel the market for power distribution units that facilitate compliance and enhance energy efficiency.

Technological Advancements in Power Distribution

Innovations in power distribution technology are reshaping the Data Center Rack Power Distribution Unit Market. The introduction of smart PDUs equipped with remote monitoring, load balancing, and real-time analytics is becoming more prevalent. These advancements enable data center operators to optimize power usage and enhance system reliability. Market data suggests that the adoption of smart PDUs is expected to increase significantly, with a projected growth rate of over 15% annually. This technological evolution not only improves operational efficiency but also supports the integration of renewable energy sources, which is becoming increasingly important in modern data center design.