Expansion of 5G Networks

The rollout of 5G networks is a transformative factor for the Spain data center market. With the promise of faster data transmission and lower latency, 5G technology is expected to drive demand for data-intensive applications such as IoT, augmented reality, and smart cities. In 2025, the number of 5G connections in Spain is projected to surpass 10 million, creating a substantial need for data processing and storage capabilities. Data centers will play a pivotal role in supporting the infrastructure required for 5G applications, as they provide the necessary bandwidth and low-latency connectivity. This expansion of 5G networks is likely to catalyze growth in the Spain data center market, as businesses and service providers seek to capitalize on the opportunities presented by this next-generation technology.

Investment in Renewable Energy

The Spain data center market is increasingly influenced by the shift towards renewable energy sources. Spain has made significant strides in renewable energy production, with wind and solar power accounting for a substantial portion of the energy mix. In 2025, renewable energy sources contributed to over 50% of the total electricity generation in Spain. This transition not only aligns with global sustainability goals but also reduces operational costs for data centers. By utilizing renewable energy, data centers can enhance their sustainability credentials while potentially lowering energy expenses. As companies prioritize environmentally friendly practices, the demand for data centers powered by renewable energy is likely to rise, positioning the Spain data center market favorably in the global landscape.

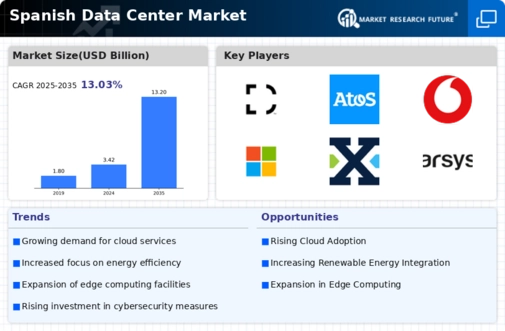

Growing Demand for Cloud Services

The increasing reliance on cloud computing solutions is a primary driver for the Spain data center market. As businesses transition to cloud-based operations, the demand for data storage and processing capabilities surges. In 2025, the cloud services market in Spain was valued at approximately 5 billion euros, reflecting a robust growth trajectory. This trend is likely to continue, as organizations seek scalable and flexible IT solutions. The Spain data center market is poised to benefit from this shift, as data centers provide the necessary infrastructure to support cloud services. Furthermore, the rise of remote work and digital transformation initiatives across various sectors is expected to further fuel the demand for data centers, making them essential for business continuity and operational efficiency.

Regulatory Framework and Data Protection Laws

The regulatory environment surrounding data protection and privacy is a crucial driver for the Spain data center market. The implementation of the General Data Protection Regulation (GDPR) has heightened the focus on data security and compliance. Organizations operating in Spain must adhere to stringent data protection laws, which necessitates the establishment of secure data storage solutions. This regulatory framework creates a demand for data centers that can ensure compliance with these laws. In 2025, it is estimated that compliance-related investments in the Spain data center market will exceed 1 billion euros, as businesses seek to mitigate risks associated with data breaches and non-compliance penalties. Consequently, data centers that prioritize security and compliance are likely to gain a competitive edge in the market.

Technological Advancements in Data Center Infrastructure

Technological innovations are reshaping the Spain data center market, driving efficiency and performance improvements. The adoption of advanced technologies such as artificial intelligence, machine learning, and automation is enhancing data center operations. In 2025, it is projected that investments in AI-driven data center management solutions will reach 500 million euros in Spain. These technologies enable data centers to optimize resource allocation, reduce energy consumption, and improve overall operational efficiency. As businesses increasingly seek to leverage these advancements, the demand for state-of-the-art data center facilities is expected to rise. This trend indicates a shift towards more intelligent and responsive data center environments, positioning the Spain data center market at the forefront of technological evolution.