Consumer Awareness and Education

Consumer awareness regarding eye health and the benefits of intraocular lenses is steadily increasing in Spain, positively influencing the Spain contact intraocular lenses market. Educational campaigns by healthcare professionals and organizations are effectively informing the public about the advantages of modern intraocular lenses, including improved vision quality and reduced recovery times. This heightened awareness is likely to lead to more patients seeking surgical options for vision correction. Furthermore, the rise of online platforms and social media has facilitated the dissemination of information, allowing potential patients to make informed decisions about their eye care. As a result, the growing consumer knowledge base is expected to drive demand within the Spain contact intraocular lenses market.

Rising Incidence of Eye Disorders

The prevalence of eye disorders, particularly cataracts and presbyopia, is on the rise in Spain, significantly impacting the Spain contact intraocular lenses market. Recent statistics indicate that approximately 30% of the Spanish population over the age of 65 suffers from cataracts, necessitating surgical intervention and the use of intraocular lenses. This demographic trend is likely to continue, as the aging population increases the demand for corrective eye surgeries. Moreover, the growing awareness of the benefits of intraocular lenses in treating these conditions is expected to further stimulate market growth. As healthcare providers increasingly recommend intraocular lenses as a standard treatment option, the Spain contact intraocular lenses market is poised for expansion.

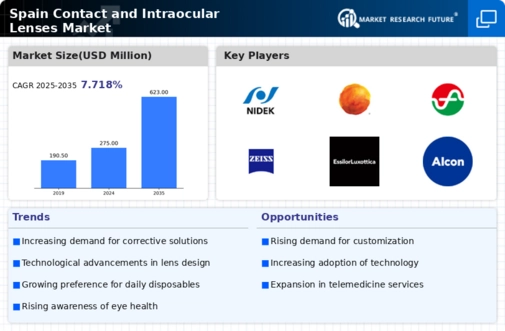

Competitive Landscape and Market Dynamics

The competitive landscape of the Spain contact intraocular lenses market is characterized by the presence of several key players, which fosters innovation and enhances product offerings. Major companies are investing in research and development to introduce new lens technologies and improve existing products. This competitive environment is likely to lead to better pricing strategies and increased availability of diverse lens options for consumers. Additionally, partnerships between manufacturers and healthcare providers are becoming more common, facilitating the distribution of advanced intraocular lenses. As competition intensifies, it is anticipated that the Spain contact intraocular lenses market will witness accelerated growth, driven by the introduction of innovative products and improved access to eye care services.

Government Initiatives and Healthcare Policies

Government initiatives aimed at improving eye care services are playing a crucial role in the Spain contact intraocular lenses market. Policies that promote regular eye examinations and subsidize surgical procedures are likely to increase patient access to intraocular lens surgeries. The Spanish government has implemented various health programs that encourage early detection and treatment of vision-related issues, which may lead to a higher demand for intraocular lenses. Additionally, the establishment of specialized eye care centers across the country is expected to enhance service delivery and patient education. As a result, these initiatives could potentially drive growth in the Spain contact intraocular lenses market, making advanced eye care more accessible to the population.

Technological Innovations in Intraocular Lenses

The Spain contact intraocular lenses market is experiencing a surge in technological innovations that enhance lens performance and patient outcomes. Advanced materials and designs, such as multifocal and toric lenses, are becoming increasingly prevalent. These innovations allow for improved vision correction and reduced dependency on glasses. According to recent data, the adoption of premium intraocular lenses has risen by approximately 25% in Spain over the past year. This trend indicates a growing preference among patients for advanced solutions that offer better visual acuity. Furthermore, the integration of digital technologies in lens manufacturing processes is likely to streamline production and improve quality control, thereby fostering growth in the Spain contact intraocular lenses market.