Growing Medical Tourism in the GCC

The GCC contact intraocular lenses market is benefiting from the growing trend of medical tourism in the region. Countries such as the UAE and Saudi Arabia are becoming popular destinations for individuals seeking high-quality eye care services, including cataract surgeries and lens implants. The availability of state-of-the-art medical facilities and skilled ophthalmologists attracts patients from neighboring regions and beyond. As a result, the demand for intraocular lenses is expected to rise, driven by both local and international patients. The GCC governments are actively promoting medical tourism, which is likely to further enhance the visibility and accessibility of advanced eye care solutions. This influx of patients seeking intraocular lens procedures could significantly contribute to the expansion of the GCC contact intraocular lenses market.

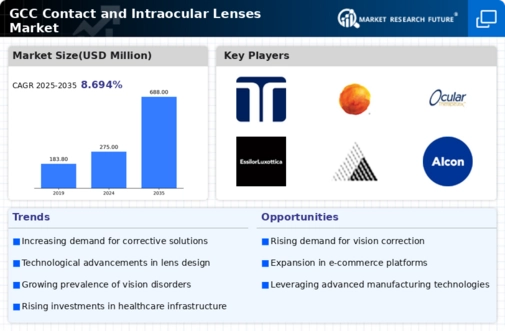

Rising Prevalence of Eye Disorders

The GCC contact intraocular lenses market is experiencing growth due to the increasing prevalence of eye disorders such as cataracts and myopia. According to regional health statistics, the incidence of cataracts is projected to rise significantly, with estimates suggesting that by 2026, over 30% of the population in certain GCC countries may be affected. This surge in eye disorders necessitates advanced surgical interventions, thereby driving demand for intraocular lenses. Furthermore, the aging population in the GCC region is likely to exacerbate this trend, as older individuals are more susceptible to vision-related issues. Consequently, healthcare providers are increasingly adopting innovative intraocular lens technologies to address these challenges, which in turn propels the GCC contact intraocular lenses market forward.

Technological Innovations in Lens Design

Technological innovations in lens design are playing a pivotal role in shaping the GCC contact intraocular lenses market. Recent advancements have led to the development of multifocal and accommodating lenses that offer improved visual outcomes for patients. These innovations not only enhance patient satisfaction but also reduce the need for additional corrective eyewear post-surgery. The introduction of premium intraocular lenses has been met with positive reception in the GCC region, as patients increasingly seek high-quality solutions for their vision problems. Market data indicates that the demand for premium lenses is on the rise, with a projected growth rate of 15% annually. This trend suggests that as technology continues to evolve, the GCC contact intraocular lenses market will likely witness sustained growth driven by consumer preferences for advanced lens options.

Increased Consumer Awareness and Education

Increased consumer awareness and education regarding eye health are crucial drivers for the GCC contact intraocular lenses market. As individuals become more informed about the benefits of corrective eye surgeries and the availability of advanced intraocular lenses, the demand for these products is likely to rise. Educational campaigns by healthcare providers and non-profit organizations are playing a vital role in disseminating information about eye health and the importance of regular eye check-ups. This heightened awareness is encouraging more individuals to consider surgical options for vision correction, thereby expanding the potential customer base for intraocular lenses. Market trends indicate that as awareness continues to grow, the GCC contact intraocular lenses market will likely experience a corresponding increase in demand for innovative lens solutions.

Government Initiatives and Healthcare Investments

Government initiatives aimed at enhancing healthcare infrastructure in the GCC region are significantly influencing the GCC contact intraocular lenses market. Various GCC nations are investing heavily in healthcare facilities and services, with budgets allocated for eye care programs. For instance, the Saudi Vision 2030 initiative emphasizes improving healthcare services, which includes the provision of advanced eye care solutions. Such investments are likely to facilitate the adoption of modern intraocular lens technologies, thereby expanding market opportunities. Additionally, public awareness campaigns about eye health are being launched, further encouraging individuals to seek corrective procedures. This supportive environment is expected to foster growth in the GCC contact intraocular lenses market, as more patients gain access to necessary treatments.