Rising Disposable Income

In Spain, the increase in disposable income among consumers seems to be positively impacting the cellulite treatment market. As individuals have more financial resources, they are likely to invest in personal care and aesthetic treatments. This trend is particularly evident among the middle and upper classes, who are more inclined to spend on non-invasive procedures and products aimed at reducing cellulite. Market data indicates that the average expenditure on beauty treatments has risen by approximately 10% over the past few years, suggesting a robust potential for growth in the cellulite treatment market. This financial capability may lead to a broader acceptance and utilization of various treatment options.

Expansion of Aesthetic Clinics

The proliferation of aesthetic clinics across Spain appears to be a significant driver for the cellulite treatment market. With an increasing number of facilities offering specialized treatments, consumers have greater access to various options for cellulite reduction. This expansion is likely to enhance competition among providers, leading to improved service quality and innovative treatment offerings. Recent statistics indicate that the number of aesthetic clinics in Spain has grown by around 15% in the last two years, reflecting a burgeoning interest in cosmetic procedures. Consequently, this trend may facilitate a more vibrant and diverse cellulite treatment market, catering to a wider audience.

Increasing Awareness of Body Positivity

The growing awareness of body positivity in Spain appears to be influencing the cellulite treatment market. As societal norms shift towards embracing diverse body types, individuals are increasingly seeking treatments that enhance their self-esteem and body image. This trend may lead to a rise in demand for various cellulite treatments, as consumers prioritize their well-being and confidence. The market could potentially see a growth rate of around 5% annually, driven by this cultural shift. Furthermore, educational campaigns promoting body positivity may encourage more individuals to explore treatment options, thereby expanding the customer base for the cellulite treatment market.

Growing Demand for Personalized Treatments

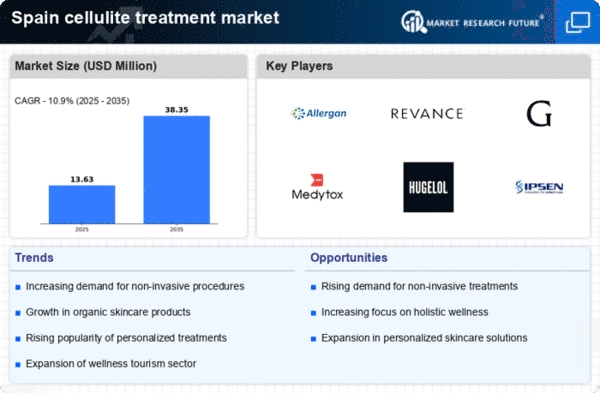

The trend towards personalized treatments in the beauty and wellness sector is gaining traction in Spain, particularly within the cellulite treatment market. Consumers are increasingly seeking tailored solutions that address their unique needs and preferences. This shift may lead to the development of customized treatment plans, combining various modalities to achieve optimal results. Market analysis suggests that personalized treatments could account for up to 20% of the overall market share in the coming years, as consumers prioritize efficacy and satisfaction. This demand for individualized care may drive innovation and diversification within the cellulite treatment market, fostering a more competitive landscape.

Influence of Social Media and Celebrity Endorsements

The impact of social media and celebrity endorsements on consumer behavior in Spain is becoming increasingly pronounced, particularly in the cellulite treatment market. Influencers and public figures often share their experiences with various treatments, which can significantly sway public perception and interest. This phenomenon may lead to heightened awareness and demand for specific products and services aimed at cellulite reduction. As a result, the market could experience a surge in sales, with estimates suggesting a potential increase of 8% in consumer engagement driven by social media campaigns. This trend underscores the importance of marketing strategies in shaping consumer choices within the cellulite treatment market.