Growing Aging Population

Spain's demographic shift towards an aging population significantly impacts the cardiac biomarkers market. With an estimated 20% of the population aged 65 and older, the demand for healthcare services, particularly in cardiology, is on the rise. Older adults are at a higher risk for cardiovascular diseases, which drives the need for effective diagnostic tools. The cardiac biomarkers market is poised to expand as healthcare providers increasingly adopt biomarkers for early diagnosis and monitoring of heart conditions in this demographic. This trend suggests a potential increase in market revenue, as the healthcare sector adapts to the needs of an aging population.

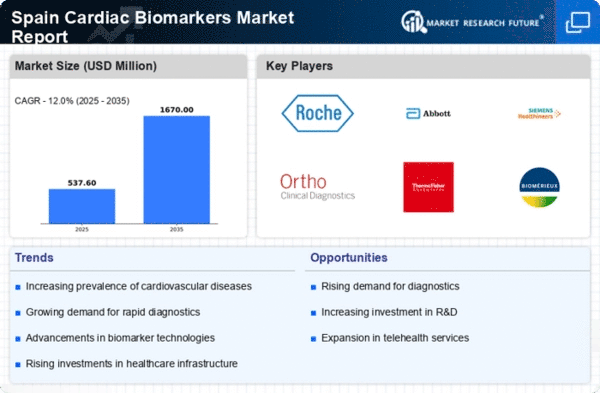

Advancements in Biomarker Research

Ongoing research and development in the field of cardiac biomarkers are propelling the market forward. Innovative studies are uncovering new biomarkers that can enhance diagnostic accuracy and patient management. For instance, the identification of novel cardiac troponins and natriuretic peptides has shown promise in improving the detection of heart failure and myocardial infarction. The cardiac biomarkers market is likely to experience growth as these advancements lead to the introduction of new products and technologies. Furthermore, increased funding for research initiatives in Spain may further accelerate the development of cutting-edge biomarkers, thereby expanding the market.

Rising Incidence of Cardiovascular Diseases

The increasing prevalence of cardiovascular diseases in Spain is a primary driver for the cardiac biomarkers market. According to recent health statistics, cardiovascular diseases account for approximately 30% of all deaths in the country. This alarming trend necessitates the development and utilization of advanced diagnostic tools, including cardiac biomarkers, to facilitate early detection and management of these conditions. As healthcare providers seek to improve patient outcomes, the demand for reliable and efficient biomarkers is expected to rise. The cardiac biomarkers market is likely to benefit from this growing need, as healthcare systems invest in innovative solutions to combat the rising burden of cardiovascular diseases.

Integration of Biomarkers in Clinical Guidelines

The incorporation of cardiac biomarkers into clinical practice guidelines is a crucial driver for the market. Spanish healthcare authorities are increasingly recognizing the importance of biomarkers in diagnosing and managing cardiovascular diseases. This integration not only enhances clinical decision-making but also encourages healthcare providers to adopt biomarker testing as a standard practice. As a result, the cardiac biomarkers market is expected to see a rise in demand for these tests, as they become integral to patient care protocols. This trend indicates a shift towards evidence-based medicine, which may further solidify the role of biomarkers in cardiovascular health.

Increased Investment in Healthcare Infrastructure

Spain's commitment to enhancing its healthcare infrastructure is positively influencing the cardiac biomarkers market. Government initiatives aimed at improving healthcare facilities and access to advanced diagnostic tools are paving the way for the adoption of cardiac biomarkers. With increased funding allocated to healthcare, hospitals and clinics are more likely to invest in state-of-the-art diagnostic technologies. This trend suggests that the cardiac biomarkers market will benefit from a more robust healthcare system, as providers seek to implement innovative solutions to improve patient outcomes and streamline diagnostic processes.