Regulatory Support for AI Integration

In Spain, regulatory bodies are increasingly recognizing the potential of AI in the financial sector. The applied ai-in-finance market benefits from supportive regulations that encourage innovation while ensuring consumer protection. Recent initiatives by the Spanish government aim to create a conducive environment for AI adoption in finance. For instance, the implementation of the Digital Financial Strategy outlines a framework for integrating AI technologies into financial services. This regulatory support is expected to foster collaboration between financial institutions and technology providers, leading to enhanced AI solutions. As a result, the applied ai-in-finance market is likely to expand, with institutions more willing to invest in AI capabilities to comply with evolving regulations.

Increased Investment in Fintech Startups

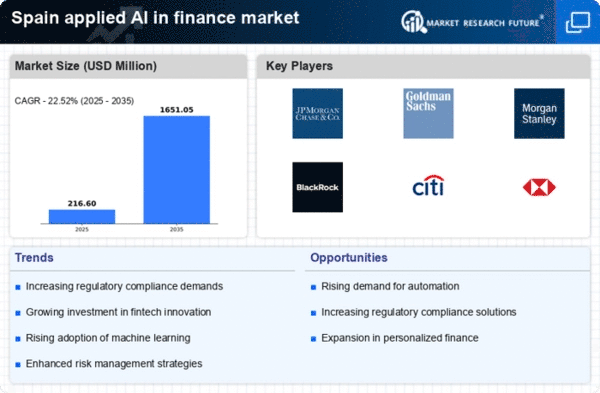

The applied ai-in-finance market is witnessing a surge in investment directed towards fintech startups in Spain. Venture capital funding for fintech companies has reached unprecedented levels, with investments exceeding €1 billion in the past year alone. This influx of capital is fostering innovation and the development of cutting-edge AI solutions tailored for the financial sector. Startups are leveraging AI to create disruptive technologies that challenge traditional financial services, enhancing competition in the market. As these startups continue to emerge, they are likely to drive the applied ai-in-finance market forward, pushing established institutions to adopt AI technologies to remain competitive.

Rising Consumer Awareness of AI Benefits

Consumer awareness regarding the benefits of AI in financial services is on the rise in Spain. As individuals become more informed about AI technologies, they are increasingly open to utilizing AI-driven financial solutions. Surveys indicate that over 60% of consumers in Spain are willing to engage with AI-based financial services, recognizing their potential for efficiency and accuracy. This growing acceptance is prompting financial institutions to invest in AI technologies to meet consumer expectations. The applied ai-in-finance market is thus likely to expand as institutions enhance their offerings to align with consumer preferences, ultimately leading to a more competitive landscape.

Advancements in Data Analytics Capabilities

The applied ai-in-finance market in Spain is significantly influenced by advancements in data analytics capabilities. Financial institutions are increasingly utilizing AI algorithms to process vast amounts of data, enabling them to derive actionable insights. This capability is crucial for risk assessment, fraud detection, and customer behavior analysis. Recent reports indicate that the market for data analytics in finance is projected to grow by over 25% annually in Spain. As institutions harness these advanced analytics tools, they can enhance decision-making processes and improve operational efficiency. Consequently, the applied ai-in-finance market is poised for growth as organizations invest in sophisticated data analytics technologies.

Growing Demand for Personalized Financial Services

The applied ai-in-finance market in Spain is experiencing a notable shift towards personalized financial services. Consumers increasingly seek tailored solutions that cater to their unique financial situations. This demand is driving financial institutions to leverage AI technologies to analyze customer data and provide customized recommendations. According to recent studies, approximately 70% of consumers in Spain express a preference for personalized financial advice. As a result, financial institutions are investing heavily in AI-driven platforms to enhance customer engagement and satisfaction. This trend not only improves customer loyalty but also increases the overall efficiency of financial services. The applied ai-in-finance market is thus positioned to grow as institutions adapt to these changing consumer expectations.