Technological Advancements in AI

The applied ai-in-finance market in Japan is experiencing a surge due to rapid technological advancements in artificial intelligence. Innovations in machine learning and natural language processing are enabling financial institutions to enhance their operational efficiency. For instance, the integration of AI algorithms in trading systems has shown to improve decision-making speed by up to 30%. Furthermore, the Japanese government has been actively promoting AI research and development, which is likely to bolster the applied ai-in-finance market. As a result, financial firms are increasingly adopting AI-driven solutions to stay competitive, potentially leading to a market growth rate of 15% annually over the next five years.

Regulatory Support and Frameworks

Regulatory support plays a crucial role in shaping the applied ai-in-finance market in Japan. The Financial Services Agency (FSA) has introduced guidelines that encourage the adoption of AI technologies while ensuring consumer protection and data privacy. This regulatory framework is expected to foster innovation and instill confidence among financial institutions. As a result, the applied ai-in-finance market is projected to expand, with an estimated increase in AI investments by 20% in the coming years. The proactive stance of regulators may also lead to the establishment of a more robust ecosystem for AI applications in finance, further driving market growth.

Increased Demand for Fraud Detection

The rising incidence of financial fraud is propelling the applied ai-in-finance market in Japan. Financial institutions are increasingly leveraging AI technologies to enhance their fraud detection capabilities. AI systems can analyze vast amounts of transaction data in real-time, identifying suspicious patterns that may indicate fraudulent activity. This capability is particularly vital in a market where losses due to fraud can reach millions of yen annually. As a result, the demand for AI-driven fraud detection solutions is expected to grow significantly, potentially increasing market revenues by 25% over the next few years. This trend underscores the critical role of AI in safeguarding financial transactions.

Consumer Demand for Enhanced User Experience

Consumer expectations in Japan are evolving, with a growing demand for enhanced user experiences in financial services. The applied ai-in-finance market is responding to this trend by developing AI-driven solutions that offer personalized services and seamless interactions. For instance, chatbots and virtual assistants are being deployed to provide 24/7 customer support, improving client satisfaction. Research indicates that 70% of consumers prefer using AI-powered tools for financial management. This shift in consumer behavior is likely to drive the applied ai-in-finance market, with projections suggesting a growth rate of 18% as firms invest in technologies that cater to user preferences.

Collaboration Between Fintech and Traditional Banks

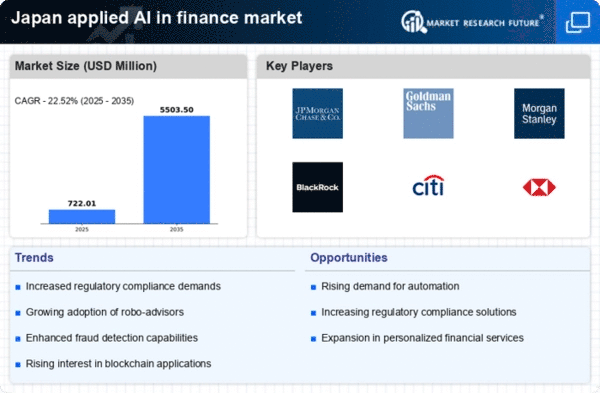

The collaboration between fintech companies and traditional banks is reshaping the applied ai-in-finance market in Japan. These partnerships are fostering innovation and enabling the integration of advanced AI technologies into established banking systems. Fintech firms often possess cutting-edge AI capabilities, while traditional banks offer extensive customer bases and regulatory knowledge. This synergy is likely to enhance service offerings and operational efficiencies. As a result, the applied ai-in-finance market may witness a compound annual growth rate (CAGR) of 22% as these collaborations become more prevalent, driving the adoption of AI solutions across the financial sector.