Rising Prevalence of Alzheimer's Disease

The increasing prevalence of Alzheimer's disease in Spain is a critical driver for the Alzheimer's disease-diagnostic market. As the population ages, the number of individuals diagnosed with Alzheimer's is expected to rise significantly. Current estimates suggest that approximately 800,000 people in Spain are living with dementia, with Alzheimer's being the most common form. This growing demographic creates a pressing need for effective diagnostic tools and services. The alzheimers disease-diagnostic market is likely to expand as healthcare providers seek to address this rising demand. Furthermore, early diagnosis is essential for effective management and treatment, which may further stimulate market growth as awareness of the disease increases among the general public.

Growing Awareness and Education Initiatives

Growing awareness and education initiatives regarding Alzheimer's disease are pivotal in shaping the Alzheimer's disease-diagnostic market. Various organizations in Spain are actively promoting understanding of the disease, its symptoms, and the importance of early diagnosis. This heightened awareness is likely to lead to increased screening and diagnostic testing among the population. Educational campaigns targeting both healthcare professionals and the general public may result in a more informed populace, which could drive demand for diagnostic services. As awareness continues to grow, the alzheimers disease-diagnostic market may experience a corresponding increase in utilization of diagnostic tools and technologies.

Regulatory Support for Diagnostic Innovations

Regulatory support for innovative diagnostic solutions is a crucial driver for the Alzheimer's disease-diagnostic market. In Spain, regulatory bodies are increasingly recognizing the need for expedited approval processes for new diagnostic tools. This supportive environment encourages companies to invest in the development of novel diagnostics, which may lead to faster market entry for innovative products. The alzheimers disease-diagnostic market stands to benefit from streamlined regulations that facilitate the introduction of advanced technologies. As regulatory frameworks adapt to support innovation, the market is likely to see a proliferation of new diagnostic options that enhance the ability to detect Alzheimer's disease at earlier stages.

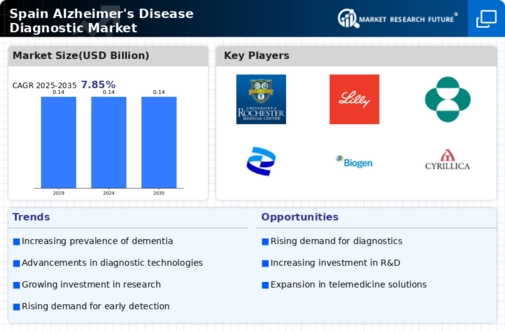

Increased Investment in Research and Development

Investment in research and development (R&D) for Alzheimer's diagnostics is another significant driver of the Alzheimer's disease-diagnostic market. In Spain, both public and private sectors are allocating substantial funds to develop innovative diagnostic technologies. For instance, the Spanish government has committed to enhancing research funding, which could lead to breakthroughs in early detection methods. The market is projected to benefit from advancements in biomarkers and imaging techniques, which may improve diagnostic accuracy. As R&D efforts intensify, the alzheimers disease-diagnostic market is expected to witness a surge in new products and services, catering to the evolving needs of healthcare professionals and patients alike.

Integration of Artificial Intelligence in Diagnostics

The integration of artificial intelligence (AI) in diagnostic processes represents a transformative driver for the Alzheimer's disease-diagnostic market. AI technologies are being increasingly utilized to analyze complex data sets, enhancing the accuracy and efficiency of Alzheimer's diagnostics. In Spain, healthcare institutions are beginning to adopt AI-driven tools that assist in early detection and personalized treatment plans. This technological advancement may lead to improved patient outcomes and reduced diagnostic errors. As AI continues to evolve, its application in the alzheimers disease-diagnostic market is expected to expand, potentially revolutionizing how healthcare providers approach diagnosis and management of Alzheimer's disease.