Rising Labor Costs

As labor costs continue to rise in South Korea, businesses are increasingly turning to automation as a viable solution to maintain competitiveness. The average wage growth in the manufacturing sector has been reported at 5% annually, prompting companies to seek cost-effective alternatives. This economic pressure is driving the demand for robot software that can optimize operations and reduce reliance on human labor. The robot software market is thus experiencing a notable uptick as organizations invest in software solutions that enable robots to perform tasks traditionally handled by human workers. This shift not only addresses labor cost concerns but also enhances operational efficiency, making it a critical driver for the market.

Surge in Automation Demand

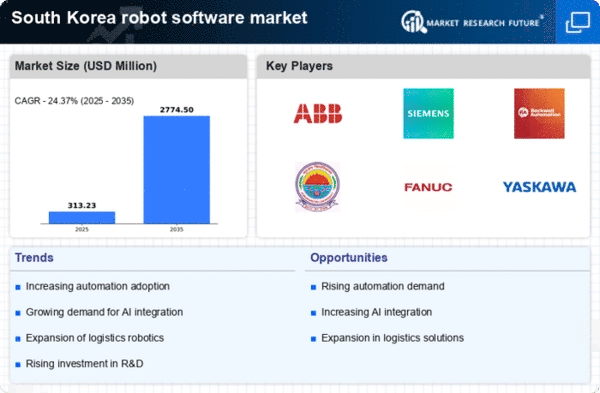

The increasing demand for automation across various sectors in South Korea is a primary driver for the robot software market. Industries such as manufacturing, logistics, and healthcare are actively seeking to enhance efficiency and reduce operational costs. In 2025, the automation market in South Korea is projected to grow by approximately 15%, indicating a robust shift towards automated solutions. This trend is likely to propel the adoption of advanced robot software, as companies aim to integrate intelligent systems that can streamline processes and improve productivity. The robot software market is thus positioned to benefit significantly from this surge in automation demand, as businesses invest in software solutions that enable robots to perform complex tasks with precision and reliability.

Growing Focus on Industry 4.0

The shift towards Industry 4.0 is reshaping the landscape of manufacturing and production in South Korea, creating a strong impetus for the robot software market. This paradigm emphasizes the integration of smart technologies, including IoT and big data analytics, into manufacturing processes. By 2025, it is projected that over 40% of South Korean manufacturers will adopt Industry 4.0 principles, necessitating advanced robot software that can seamlessly integrate with existing systems. This focus on digital transformation is likely to drive demand for software solutions that enhance connectivity and data exchange between robots and other machinery. Consequently, the robot software market stands to gain significantly as businesses invest in technologies that facilitate this transition.

Government Initiatives and Support

The South Korean government has been actively promoting the adoption of robotics and automation technologies through various initiatives and funding programs. In 2025, government investments in the robot software market are expected to reach around $500 million, aimed at fostering innovation and supporting local companies in developing advanced robotic solutions. These initiatives not only provide financial backing but also create a favorable regulatory environment for the growth of the robot software market. By encouraging research and development, the government is likely to stimulate the creation of cutting-edge software that enhances the capabilities of robots, thereby driving market expansion and positioning South Korea as a leader in robotics.

Technological Advancements in Robotics

The rapid pace of technological advancements in robotics is significantly influencing the robot software market. Innovations in artificial intelligence, machine learning, and sensor technologies are enabling the development of more sophisticated robotic systems. In 2025, it is anticipated that the integration of AI-driven software will account for over 30% of the total robot software market in South Korea. These advancements allow robots to perform complex tasks with greater autonomy and adaptability, thereby expanding their applications across various industries. As companies seek to leverage these technologies, the robot software market is likely to witness substantial growth, driven by the demand for cutting-edge software solutions that enhance robotic capabilities.