Research Methodology on Robot Software Market

1. Introduction:

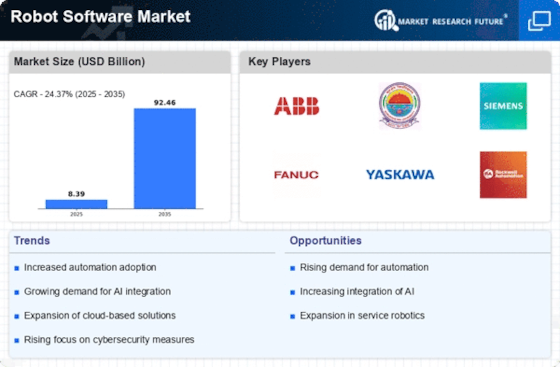

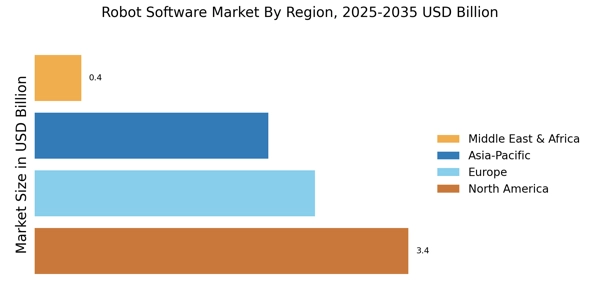

Market Research Future (MRFR) conducted a comprehensive in-depth study on the Global Robot Software Market to understand the structure and dynamics of the overall market. The study took into consideration past performance and current trends in order to understand the future potential of the robot software market. The study also took into account the numerous challenges and opportunities that the robot software market is facing in this period of time and how they would impact the market in the future.

2. Research Design:

This study was conducted through a combination of qualitative and quantitative methods for data gathering and analysis. The research focused on past and future market practices, trends and forecasts. For the qualitative data analysis, MRFR looked at various factors such as market dynamics, the competitive landscape, opportunities, and constraints. For the quantitative research, MRFR used market size and market share analysis, correlation coefficients, and regression modelling.

3. Data Sources:

MRFR collected data from both primary and secondary sources. Primary sources included industry experts, industry professionals, and industry stakeholders. The primary sources provided information on the current market size, market share, competitive landscape, and forecasts. Secondary sources included industry journals, research reports, company databases, and online resources.

4. Data Collection Office:

Data collection was carried out using a combination of online and offline research. Online research was conducted using web-based tools and various research websites such as Google, Yahoo, and Bing. Offline research was carried out with the help of industry experts and industry stakeholders. Data collection was conducted by the research team at MRFR.

5. Assumptions

Various assumptions were taken into consideration during the research process. These included the current trends in the market, future market opportunities, and the future market potential. The assumptions also include economic and social factors, as well as other external factors that could impact the market. These assumptions were validated by industry experts and industry stakeholders.

6. Conclusion:

Through extensive primary and secondary research, MRFR has gathered valuable insights into the Global Robot Software Market. The insights gathered will help stakeholders develop effective strategies to succeed in the market and make profitable investments in the robot software market. MRFR believes that the market is likely to show steady growth during the forecast period 2023 to 2030.