Rising Energy Transition Efforts

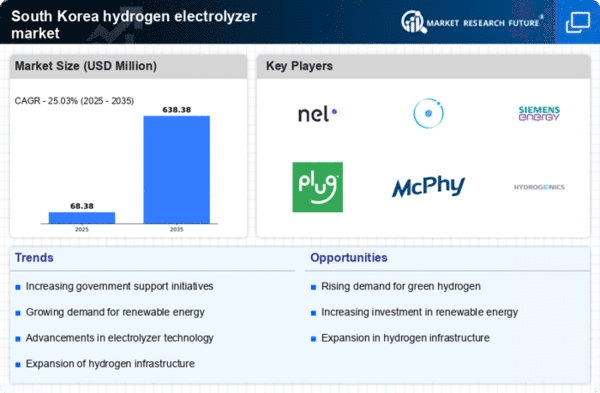

The hydrogen electrolyzer market in South Korea is experiencing a surge due to the nation's commitment to energy transition. The government has set ambitious targets to reduce greenhouse gas emissions by 40% by 2030, which necessitates a shift towards cleaner energy sources. This transition is likely to drive investments in hydrogen production technologies, including electrolyzers. As of 2025, South Korea aims to have 6.2 GW of electrolyzer capacity installed, reflecting a significant increase in market activity. The focus on renewable energy sources, such as wind and solar, further supports the growth of the hydrogen electrolyzer market, as these sources provide the necessary electricity for efficient hydrogen production.

Growing Demand for Renewable Hydrogen

The demand for renewable hydrogen is on the rise in South Korea, significantly impacting the hydrogen electrolyzer market. Industries are increasingly seeking sustainable alternatives to fossil fuels, and hydrogen produced via electrolysis from renewable sources is seen as a viable solution. The South Korean government has set a target to produce 1.5 million tons of hydrogen annually by 2030, with a substantial portion expected to come from electrolyzers. This growing demand is likely to drive technological advancements and increase the adoption of electrolyzers across various sectors, including transportation and manufacturing, thereby enhancing the overall market landscape.

Regulatory Framework and Policy Support

The regulatory framework and policy support in South Korea are crucial for the hydrogen electrolyzer market's growth. The government has implemented various policies aimed at promoting hydrogen as a key energy source. These include tax incentives, subsidies, and regulatory measures that encourage the adoption of hydrogen technologies. The Hydrogen Economy Roadmap outlines specific goals for hydrogen production and utilization, which are expected to create a favorable environment for the hydrogen electrolyzer market. As the regulatory landscape evolves, it is likely to provide the necessary support for market players, fostering innovation and investment in electrolyzer technologies.

Strategic Partnerships and Collaborations

Strategic partnerships and collaborations are emerging as a vital driver for the hydrogen electrolyzer market in South Korea. Companies are increasingly forming alliances to leverage each other's strengths in technology and market access. For instance, collaborations between energy firms and technology providers are likely to enhance the development of advanced electrolyzer systems. These partnerships can facilitate knowledge sharing and accelerate the commercialization of innovative solutions. As of November 2025, several joint ventures have been established, aiming to boost the production capacity of electrolyzers, which may lead to a more robust market presence and increased competitiveness.

Increased Investment in Clean Technologies

Investment in clean technologies is a critical driver for the hydrogen electrolyzer market in South Korea. The government has allocated approximately $2.5 billion to support the development of hydrogen infrastructure and production facilities. This financial backing is expected to stimulate private sector investments, leading to advancements in electrolyzer technology. Furthermore, the South Korean government has introduced various incentives for companies that invest in hydrogen production, which could potentially enhance the competitiveness of the hydrogen electrolyzer market. As the market matures, the influx of capital is likely to foster innovation and reduce costs, making hydrogen a more viable energy source.