Supportive Regulatory Frameworks

The hydrogen electrolyzer market in France is bolstered by supportive regulatory frameworks that encourage the adoption of hydrogen technologies. The French government has implemented various policies and incentives aimed at promoting clean hydrogen production and utilization. For instance, the Hydrogen Plan launched in 2020 outlines a roadmap for the development of hydrogen technologies, including electrolyzers. This plan allocates €7 billion for hydrogen initiatives, which is expected to stimulate market growth. Additionally, regulations that favor low-carbon technologies create a conducive environment for investments in the hydrogen electrolyzer market, potentially leading to increased market penetration and innovation.

Rising Demand for Clean Energy Solutions

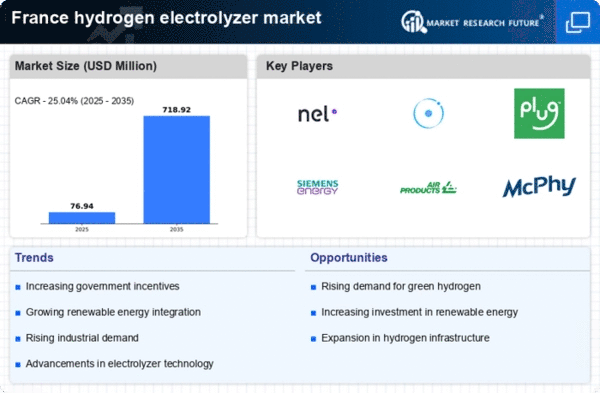

The hydrogen electrolyzer market in France is experiencing a notable surge in demand driven by the increasing emphasis on clean energy solutions. As the nation aims to reduce its carbon footprint, the adoption of hydrogen as a clean fuel source is becoming more prevalent. The French government has set ambitious targets to achieve carbon neutrality by 2050, which includes a significant role for hydrogen technologies. This shift is reflected in the projected growth of the hydrogen electrolyzer market, which is expected to expand at a CAGR of approximately 20% over the next decade. The growing awareness of environmental issues among consumers and industries further propels this demand, indicating a robust future for the hydrogen electrolyzer market in France.

Technological Innovations in Electrolysis

Technological innovations in electrolysis are significantly influencing the hydrogen electrolyzer market in France. Advances in electrolyzer efficiency and cost reduction technologies are making hydrogen production more economically viable. Innovations such as proton exchange membrane (PEM) electrolyzers and alkaline electrolyzers are gaining traction due to their improved performance and lower energy consumption. The ongoing research and development efforts in this field suggest that the hydrogen electrolyzer market will continue to evolve, with new technologies emerging that could further enhance production capabilities. As these innovations become commercially available, they are likely to attract more investments and drive market growth in France.

Growing Industrial Applications of Hydrogen

The hydrogen electrolyzer market in France is increasingly driven by the growing industrial applications of hydrogen. Industries such as chemicals, refining, and transportation are recognizing the potential of hydrogen as a clean energy carrier. The demand for hydrogen in these sectors is expected to rise, particularly as companies seek to decarbonize their operations. For instance, the chemical industry is projected to account for a significant share of hydrogen consumption, with estimates suggesting that hydrogen demand could reach 3 million tonnes by 2030. This industrial shift towards hydrogen utilization is likely to create new opportunities for the hydrogen electrolyzer market, fostering growth and innovation in the sector.

Investment in Renewable Energy Infrastructure

Investment in renewable energy infrastructure is a critical driver for the hydrogen electrolyzer market in France. The government has committed substantial financial resources to enhance renewable energy production, particularly in wind and solar sectors. This investment is essential for generating the green electricity required for efficient hydrogen production through electrolysis. Reports suggest that France aims to increase its renewable energy share to 40% by 2030, which will likely create a favorable environment for hydrogen electrolyzers. As the infrastructure develops, the hydrogen electrolyzer market is poised to benefit from increased production capacity and lower operational costs, making it a more attractive option for energy producers and consumers alike.