Focus on Patient-Centric Care

The shift towards patient-centric care in South Korea is reshaping the handheld surgical-devices market. Healthcare providers are increasingly prioritizing patient outcomes and experiences, leading to a demand for devices that facilitate minimally invasive procedures. This approach not only enhances patient satisfaction but also reduces hospital stays and recovery times. As a result, the market for handheld surgical devices that support these practices is expected to grow. In 2025, it is estimated that minimally invasive surgeries will account for over 60% of all surgical procedures, underscoring the need for innovative handheld solutions. The emphasis on patient-centric care is likely to drive manufacturers to develop devices that align with these evolving healthcare priorities.

Surge in Geriatric Population

The demographic shift towards an aging population in South Korea significantly influences the handheld surgical-devices market. By 2025, it is anticipated that over 20% of the population will be aged 65 and older, leading to a higher prevalence of age-related health issues requiring surgical intervention. This demographic trend necessitates the development and adoption of specialized handheld surgical devices tailored for geriatric patients. The increasing incidence of chronic diseases, such as cardiovascular disorders and orthopedic conditions, further drives the demand for these devices. As healthcare providers seek to address the unique needs of older patients, the handheld surgical-devices market is likely to expand, offering innovative solutions that enhance surgical outcomes and improve recovery times for this demographic.

Increasing Healthcare Expenditure

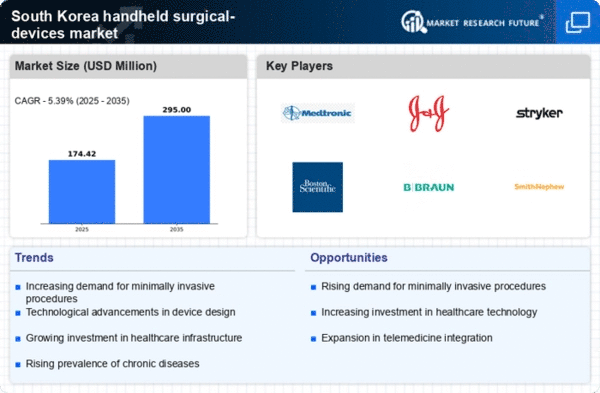

The rising healthcare expenditure in South Korea is a pivotal driver for the handheld surgical-devices market. As the government and private sectors allocate more funds towards healthcare, the demand for advanced surgical tools is likely to increase. In 2025, healthcare spending is projected to reach approximately 9.5% of the GDP, reflecting a growing commitment to improving medical facilities and technologies. This financial support enables hospitals and surgical centers to invest in innovative handheld devices, enhancing surgical precision and patient outcomes. Furthermore, the increasing number of surgical procedures performed annually, estimated to be around 1.5 million, further propels the need for efficient and effective handheld surgical devices. As healthcare budgets expand, the market is expected to witness substantial growth, driven by the need for improved surgical capabilities.

Rising Awareness of Surgical Innovations

The growing awareness of surgical innovations among healthcare professionals and patients is a significant driver for the handheld surgical-devices market. As medical education and training programs increasingly emphasize the importance of new technologies, surgeons are becoming more informed about the benefits of advanced handheld devices. This heightened awareness is likely to lead to greater adoption rates of these devices in surgical settings. Additionally, patient education initiatives are fostering a better understanding of the advantages of modern surgical techniques, which may influence their preferences for specific procedures. As awareness continues to rise, the demand for handheld surgical devices that offer enhanced functionality and improved outcomes is expected to increase, further propelling market growth.

Technological Integration in Surgical Procedures

The integration of advanced technologies into surgical procedures is a crucial driver for the handheld surgical-devices market. Innovations such as robotics, augmented reality, and artificial intelligence are increasingly being incorporated into surgical practices, enhancing the capabilities of handheld devices. In South Korea, the adoption of these technologies is expected to grow, with a projected market value of $1.2 billion for surgical robotics by 2026. This technological evolution not only improves surgical precision but also reduces recovery times and minimizes complications. As healthcare professionals become more adept at utilizing these advanced tools, the demand for sophisticated handheld surgical devices is likely to rise, fostering a competitive landscape within the market.