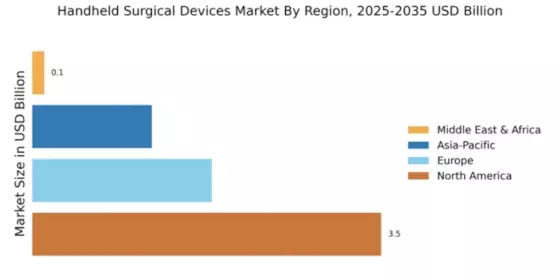

North America : Market Leader in Innovation

North America continues to lead the handheld surgical devices market, holding a significant share of 3.5 billion in 2024. The region's growth is driven by advanced healthcare infrastructure, increasing surgical procedures, and a rising demand for minimally invasive surgeries. Regulatory support from agencies like the FDA further catalyzes innovation and adoption of new technologies, ensuring high standards in surgical practices. The competitive landscape is robust, with key players such as Medtronic, Johnson & Johnson, and Stryker dominating the market. The presence of these industry giants fosters a culture of innovation and quality, contributing to the region's market strength. Additionally, the U.S. healthcare system's focus on improving patient outcomes drives the demand for advanced handheld surgical devices, solidifying North America's position as a market leader.

Europe : Emerging Market with Growth Potential

Europe's handheld surgical devices market is valued at 1.8 billion, reflecting a growing demand for innovative surgical solutions. Factors such as an aging population, increasing prevalence of chronic diseases, and advancements in surgical technologies are propelling market growth. Regulatory frameworks, including the EU Medical Device Regulation, ensure safety and efficacy, fostering consumer confidence in new products. Leading countries like Germany, France, and the UK are at the forefront of this market, supported by strong healthcare systems and significant investments in medical technology. Key players such as B. Braun Melsungen AG and Smith & Nephew are enhancing their product offerings to meet the evolving needs of healthcare providers. The competitive landscape is characterized by collaborations and partnerships aimed at driving innovation and expanding market reach.

Asia-Pacific : Rapidly Growing Market Segment

The Asia-Pacific region is witnessing a surge in the handheld surgical devices market, currently valued at 1.2 billion. This growth is fueled by increasing healthcare expenditure, rising surgical procedures, and a growing awareness of advanced surgical techniques. Governments are investing in healthcare infrastructure, which is expected to further enhance market dynamics and accessibility to innovative surgical solutions. Countries like Japan, China, and India are leading the charge, with a mix of local and international players competing for market share. Companies such as Olympus Corporation are expanding their presence in the region, focusing on product innovation and strategic partnerships. The competitive landscape is evolving, with a strong emphasis on affordability and accessibility to meet the diverse needs of the population, driving the market forward.

Middle East and Africa : Emerging Market with Challenges

The Middle East and Africa region represents a nascent market for handheld surgical devices, valued at 0.12 billion. Despite challenges such as regulatory hurdles and varying healthcare standards, the region is gradually witnessing growth driven by increasing investments in healthcare infrastructure and rising surgical needs. Governments are focusing on improving healthcare access, which is expected to boost demand for advanced surgical devices in the coming years. Countries like South Africa and the UAE are leading the market, with a growing number of healthcare facilities adopting innovative surgical technologies. However, the competitive landscape remains fragmented, with both local and international players vying for market presence. Companies are focusing on tailored solutions to meet regional needs, which is crucial for capturing market share in this developing landscape.