Supportive Regulatory Environment

A supportive regulatory environment plays a pivotal role in shaping the generic injectables market in South Korea. The government has implemented policies aimed at facilitating the approval and market entry of generic products, which encourages competition and drives down prices. Regulatory bodies are increasingly streamlining the approval process for generics, thereby reducing the time to market. This proactive approach not only benefits manufacturers but also enhances patient access to essential medications. As a result, the market is expected to witness a steady growth trajectory, with an anticipated increase of 6% in the coming years.

Increasing Prevalence of Chronic Diseases

The rising prevalence of chronic diseases in South Korea serves as a critical driver for the generic injectables market. Conditions such as diabetes, cancer, and cardiovascular diseases necessitate ongoing treatment, leading to a higher consumption of injectable medications. According to recent health statistics, approximately 30% of the population is affected by chronic illnesses, which underscores the urgent need for accessible treatment options. This growing patient population is likely to propel the demand for generic injectables, as they offer a more affordable alternative to branded therapies, thereby expanding the market's reach.

Rising Demand for Cost-Effective Solutions

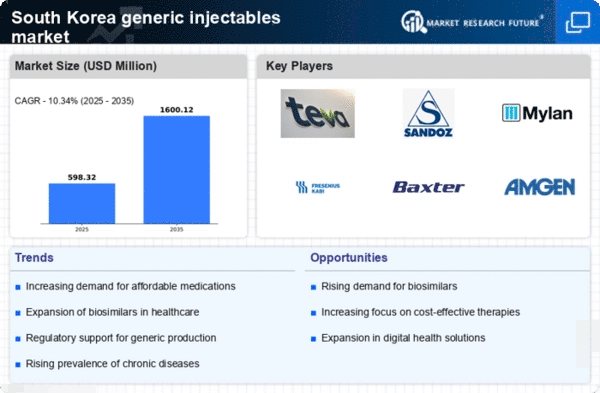

The generic injectables market in South Korea experiences a notable increase in demand for cost-effective healthcare solutions. As healthcare costs continue to rise, both patients and healthcare providers are seeking affordable alternatives to branded injectables. This trend is particularly evident in the context of chronic diseases, where the need for long-term treatment options drives the market. In 2025, the market is projected to grow at a CAGR of approximately 8.5%, reflecting the increasing preference for generics. The economic burden of healthcare expenses compels stakeholders to consider generic injectables as viable options. This consideration enhances their market presence.

Technological Advancements in Manufacturing

Technological innovations in the manufacturing processes of injectables significantly impact the generic injectables market in South Korea. Advanced production techniques, such as automated filling and packaging, enhance efficiency and reduce costs. These improvements not only streamline operations but also ensure higher quality and safety standards, which are crucial in the pharmaceutical industry. As a result, manufacturers are better positioned to meet the growing demand for generic injectables. The integration of cutting-edge technologies is expected to contribute to a projected market growth of 7% annually, as companies strive to optimize their production capabilities.

Growing Awareness Among Healthcare Professionals

There is a growing awareness among healthcare professionals regarding the benefits of generic injectables, which significantly influences the market landscape in South Korea. Physicians and pharmacists are increasingly recognizing the efficacy and safety of generics, leading to a shift in prescribing practices. Educational initiatives and training programs aimed at healthcare providers have contributed to this trend, fostering a more favorable perception of generic products. As healthcare professionals advocate for the use of generics, the market is likely to expand, with an estimated growth rate of 5.5% projected over the next few years.