Rising Demand for Renewable Energy

The energy storage market in South Korea is experiencing a notable surge in demand due to the increasing reliance on renewable energy sources. As the nation aims to achieve its ambitious renewable energy targets, the integration of energy storage systems becomes essential for balancing supply and demand. In 2025, renewable energy accounted for approximately 20% of South Korea's total energy mix, and this figure is projected to rise significantly. Energy storage solutions, particularly lithium-ion batteries, are crucial for managing the intermittent nature of solar and wind energy. This growing demand for renewables is likely to drive investments in energy storage technologies, thereby enhancing the overall capacity and efficiency of the energy storage market. The energy storage market industry is thus positioned to benefit from this transition towards a greener energy landscape.

Increasing Energy Security Concerns

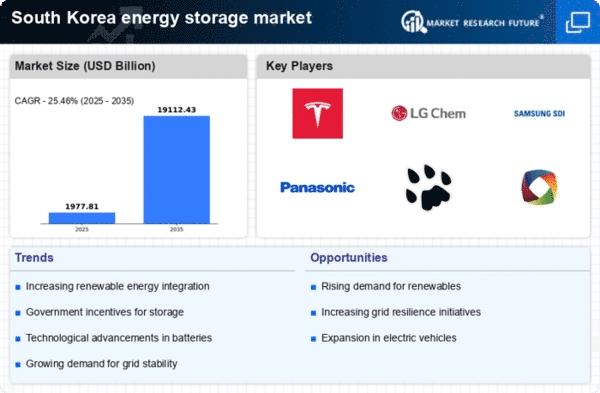

Energy security has become a pressing issue for South Korea, particularly in light of geopolitical tensions and fluctuating energy prices. The energy storage market is seen as a viable solution to enhance energy resilience and reduce dependence on imported fossil fuels. By investing in energy storage systems, South Korea aims to create a more stable and reliable energy supply. In 2025, the energy storage market industry is projected to grow by approximately 15% annually, driven by the need for backup power solutions and grid stability. This growth is indicative of a broader trend towards energy independence, as stakeholders recognize the importance of diversifying energy sources and enhancing grid reliability. Consequently, the energy storage market is likely to play a crucial role in addressing these energy security challenges.

Growing Interest from Private Sector

The private sector's interest in the energy storage market is rapidly increasing, as companies recognize the potential for cost savings and operational efficiencies. Many businesses are investing in energy storage systems to manage energy costs and enhance sustainability efforts. In 2025, it is estimated that corporate investments in energy storage technologies will exceed $1 billion, reflecting a growing trend towards energy self-sufficiency. The energy storage market industry is likely to benefit from this influx of private capital, which can drive innovation and accelerate the deployment of energy storage solutions. Additionally, partnerships between private companies and technology providers are expected to foster the development of new applications and services within the energy storage market. This collaborative approach may lead to enhanced competitiveness and further growth opportunities.

Government Support and Regulatory Framework

The South Korean government is actively promoting the energy storage market through various support mechanisms and regulatory frameworks. Initiatives such as subsidies, tax incentives, and grants are designed to encourage the deployment of energy storage systems across the country. In 2025, the government has allocated approximately $500 million to support energy storage projects, reflecting its commitment to enhancing energy security and sustainability. Furthermore, regulatory measures are being implemented to streamline the approval process for energy storage installations, thereby facilitating market entry for new players. The energy storage market industry is likely to benefit from this supportive environment, as it fosters innovation and encourages investment in energy storage technologies. This proactive approach by the government is expected to accelerate the growth of the energy storage market.

Technological Advancements in Energy Storage

Technological innovations are playing a pivotal role in shaping the energy storage market in South Korea. Recent advancements in battery technologies, such as solid-state batteries and flow batteries, are enhancing energy density, safety, and longevity. These innovations are expected to reduce costs and improve the performance of energy storage systems. In 2025, the average cost of lithium-ion batteries has decreased by approximately 50% compared to previous years, making energy storage solutions more accessible for both residential and commercial applications. The energy storage market industry is likely to witness increased adoption of these advanced technologies, which could lead to more efficient energy management and a reduction in reliance on fossil fuels. As a result, the energy storage market is becoming increasingly competitive and attractive for investors.