The Energy Storage Market is currently experiencing a notable transformation, driven by the increasing demand for renewable energy integration and the need for grid flexibility. Organizations are gravitating towards battery energy storage solutions due to their ability to provide enhanced performance, reliability, and control over power systems. This shift is particularly evident in sectors such as utilities, renewable energy providers, and industrial applications, where energy security and reliability are paramount. As businesses seek to optimize their operations and meet decarbonization targets, the appeal of energy storage systems continues to grow, suggesting a robust trajectory for this market segment.

Moreover, the rise of hybrid renewable energy strategies appears to be influencing the Energy Storage Market significantly. Countries are increasingly adopting a combination of solar, wind, and storage solutions, which allows them to leverage the benefits of both variable renewable generation and dispatchable storage. This trend indicates a potential for greater flexibility and scalability, as organizations can tailor their energy infrastructure to meet specific needs. As the landscape evolves, the Energy Storage Market is likely to witness further innovations and enhancements, positioning it as a critical component of modern energy strategies.

Renewable Energy Expansion

In 2024, the European Union achieved a record milestone where 46.9% of its net electricity generation came from renewable energy sources. This transition marks a fundamental shift in the continent's energy landscape. Among EU countries, Denmark led the pack with 88.4% renewable share, heavily reliant on wind energy. Portugal followed at 87.5%, supported by a balanced contribution of wind and hydro, while Croatia reached 73.7%, driven mainly by hydro. As renewables contribute nearly half of the EU's electricity, the intermittency of wind and solar creates urgent grid management challenges. Wind and hydro accounted for a combined 69% of renewable electricity, while solar contributed 22.4%, reflecting its growing importance. To mitigate curtailment and ensure reliability, energy storage systems such as lithium-ion batteries, pumped hydro, and flow batteries are becoming indispensable.

Policy & Regulatory Support

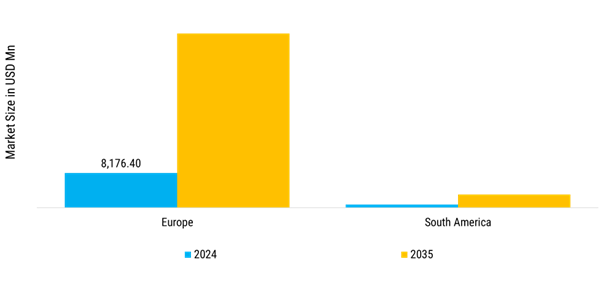

Europe's energy storage policy ecosystem has matured significantly, anchored by a series of forward-looking EU-level directives and strategic plans. The 2019 Clean Energy for All Europeans package laid the groundwork by recognizing storage as an independent asset class, granting it non-discriminatory access to markets and grid infrastructure. A critical milestone came with the Batteries Regulation, enforced on 17 August 2023, which mandates the collection, reuse, and recycling of all battery types. Chile and Colombia remain frontrunners in Latin America's energy storage policy evolution. In Chile, storage policy is rooted in the General Electricity Services Law and reinforced by Supreme Decree 70, which explicitly enables storage systems to participate in power markets. Brazil, South America's largest electricity market, is progressing through a phased storage integration strategy led by its national energy regulator, ANEEL.

Falling Battery Costs

A transformative opportunity lies in the falling cost of lithium-ion batteries, which dropped to $115/kWh in 2024, the lowest on record. This cost decline is enabling storage to scale not only in grid-scale applications but also in distributed and behind-the-meter use cases. In South America, residential and commercial users, especially in Brazil and Chile, are combining rooftop solar with battery energy storage systems to reduce grid reliance and improve energy resilience. In Europe, advanced battery integration is supporting smart grids, electric vehicle infrastructure, and decentralized energy trading platforms.

The ongoing evolution of energy storage infrastructure suggests that the Energy Storage Market is poised to experience robust growth, driven by increasing demand for renewable energy integration and enhanced grid flexibility features.