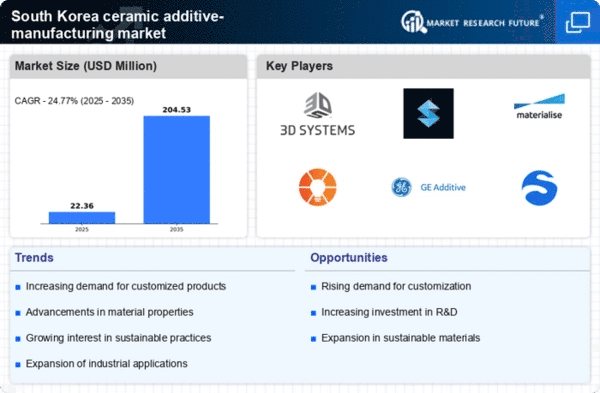

The ceramic additive-manufacturing market in South Korea is characterized by a dynamic competitive landscape, driven by technological advancements and increasing demand for customized solutions. Key players such as 3D Systems (US), Stratasys (US), and GE Additive (US) are at the forefront, each adopting distinct strategies to enhance their market presence. 3D Systems (US) focuses on innovation through continuous development of advanced materials and processes, while Stratasys (US) emphasizes partnerships with local manufacturers to expand its footprint. GE Additive (US) is leveraging its expertise in industrial applications to cater to the growing needs of sectors like aerospace and healthcare, thereby shaping a competitive environment that prioritizes technological prowess and strategic collaborations.In terms of business tactics, companies are increasingly localizing manufacturing to reduce lead times and optimize supply chains. The market structure appears moderately fragmented, with several players vying for market share, yet the influence of major companies remains substantial. This collective presence fosters a competitive atmosphere where innovation and operational efficiency are paramount, allowing firms to differentiate themselves in a crowded marketplace.

In October 3D Systems (US) announced a strategic partnership with a leading South Korean university to develop next-generation ceramic materials for additive manufacturing. This collaboration is poised to enhance research capabilities and accelerate the commercialization of innovative products, reflecting the company's commitment to advancing material science and fostering local talent.

In September Stratasys (US) unveiled a new ceramic 3D printing system designed specifically for the South Korean market, aimed at industries such as electronics and automotive. This launch signifies Stratasys's intent to cater to regional demands while reinforcing its position as a leader in additive manufacturing technology, potentially increasing its market share in a competitive landscape.

In August GE Additive (US) expanded its operations in South Korea by establishing a new facility dedicated to ceramic additive manufacturing. This strategic move not only enhances production capacity but also aligns with the company's goal of providing localized solutions to its clients, thereby improving supply chain reliability and responsiveness to market needs.

As of November current trends in the ceramic additive-manufacturing market include a strong emphasis on digitalization, sustainability, and the integration of AI technologies. Strategic alliances are increasingly shaping the competitive landscape, enabling companies to pool resources and expertise. Looking ahead, the competitive differentiation is likely to evolve from traditional price-based competition towards a focus on innovation, technological advancements, and supply chain resilience, underscoring the importance of adaptability in a rapidly changing market.