Rising Investment in R&D

Rising investment in research and development (R&D) is a crucial driver for the automated optical-inspection-system market in South Korea. Companies are allocating substantial resources to innovate and develop advanced inspection technologies that meet the evolving demands of various industries. In 2025, it is anticipated that R&D expenditures in this sector will increase by approximately 15%, reflecting a commitment to enhancing inspection capabilities and maintaining competitive advantage. This focus on innovation is likely to lead to the introduction of more sophisticated systems, further propelling the growth of the automated optical-inspection-system market.

Growing Focus on Automation

The growing focus on automation within South Korean manufacturing industries is significantly impacting the automated optical-inspection-system market. As companies strive to enhance productivity and reduce labor costs, the adoption of automated inspection systems is becoming increasingly prevalent. In 2025, the market is expected to witness a notable increase, with automation technologies projected to capture around 40% of the overall inspection market. This trend suggests that manufacturers are prioritizing the implementation of automated solutions to streamline processes and improve overall efficiency, thereby driving the growth of the automated optical-inspection-system market.

Expansion of Electronics Manufacturing

The expansion of the electronics manufacturing sector in South Korea is significantly influencing the automated optical-inspection-system market. As the country remains a global leader in electronics production, the demand for high-precision inspection systems is on the rise. In 2025, the electronics industry is projected to contribute over 50% of the total market revenue for automated optical-inspection systems. This growth is driven by the need for stringent quality control measures to ensure product reliability and performance. Consequently, the automated optical-inspection-system market is poised for substantial growth as manufacturers seek to implement advanced inspection solutions to meet these demands.

Integration of Artificial Intelligence

The integration of artificial intelligence (AI) into inspection systems is transforming the automated optical-inspection-system market in South Korea. AI technologies enable systems to learn from data, improving their accuracy and efficiency over time. This advancement is particularly relevant in sectors where complex inspections are required, such as semiconductor manufacturing. By 2025, it is estimated that AI-enhanced systems could account for nearly 30% of the market share, as companies seek to leverage AI for predictive maintenance and real-time quality control. This shift not only enhances inspection capabilities but also reduces operational costs, making AI a key driver in the automated optical-inspection-system market.

Increasing Demand for Precision Manufacturing

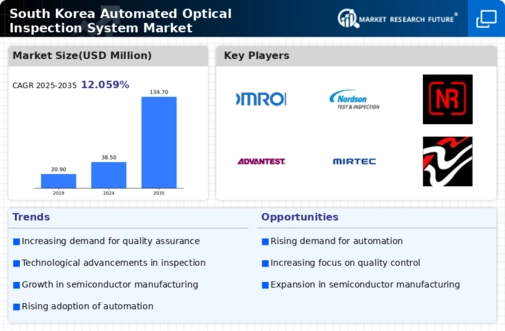

The automated optical inspection system market in South Korea is experiencing a surge in demand. This demand is driven by the need for precision manufacturing across various industries. As sectors such as electronics, automotive, and pharmaceuticals continue to evolve, the requirement for high-quality inspection systems becomes paramount. In 2025, the market is projected to grow at a CAGR of approximately 8.5%, reflecting the increasing reliance on automated systems to ensure product quality and compliance with stringent regulations. This trend indicates that manufacturers are investing heavily in advanced inspection technologies to enhance operational efficiency and reduce defects, thereby propelling the growth of the automated optical-inspection-system market.