Government Initiatives and Funding

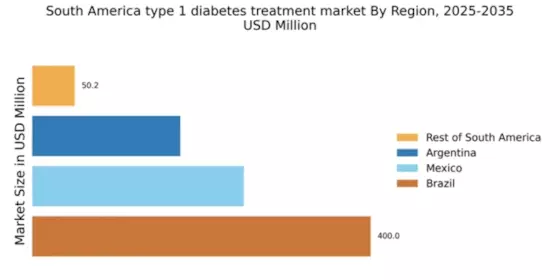

Government initiatives aimed at improving diabetes care in South America significantly influence the type 1-diabetes-treatment market. Various countries in the region have implemented national diabetes programs that focus on early diagnosis, treatment accessibility, and patient education. For instance, Brazil has allocated substantial funding to enhance diabetes management, which includes subsidizing insulin and other essential medications. Such initiatives not only improve patient outcomes but also encourage pharmaceutical companies to invest in the development of new therapies. The commitment of governments to combat diabetes is likely to create a favorable environment for the type 1-diabetes-treatment market, fostering innovation and accessibility.

Rising Awareness and Education Programs

The increasing awareness of type 1 diabetes and the importance of education programs are vital drivers for the type 1-diabetes-treatment market in South America. Various non-profit organizations and healthcare providers are actively promoting diabetes education, which empowers patients and caregivers to manage the condition effectively. These initiatives have been shown to improve patient outcomes and reduce complications associated with diabetes. As awareness grows, more individuals are likely to seek treatment options, thereby expanding the market. The emphasis on education is expected to lead to a more informed patient population, which could positively impact the type 1-diabetes-treatment market.

Technological Advancements in Treatment

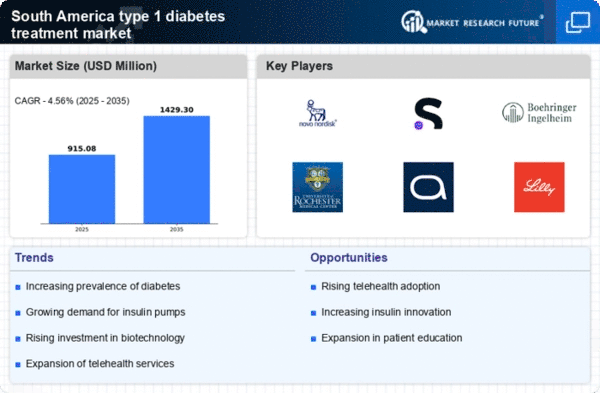

Technological innovations play a pivotal role in shaping the type 1-diabetes-treatment market in South America. The introduction of advanced insulin delivery systems, such as insulin pumps and continuous glucose monitoring devices, has transformed diabetes management. These technologies enhance patient adherence and improve glycemic control, which is crucial for individuals with type 1 diabetes. The market for these devices is projected to grow significantly, with estimates indicating a compound annual growth rate (CAGR) of around 10% over the next five years. As more patients gain access to these technologies, the demand for integrated treatment solutions is expected to rise, further propelling the type 1-diabetes-treatment market.

Increasing Prevalence of Type 1 Diabetes

The rising incidence of type 1 diabetes in South America is a critical driver for the type 1-diabetes-treatment market. Recent studies indicate that the prevalence of this autoimmune condition is increasing, with estimates suggesting that approximately 1 in 300 children are diagnosed with type 1 diabetes. This growing patient population necessitates enhanced treatment options and management strategies, thereby propelling market growth. Furthermore, the increasing awareness of diabetes and its complications among the South American population is likely to drive demand for effective therapies. As healthcare systems adapt to this rising burden, investments in research and development for innovative treatments are expected to increase, further stimulating the type 1-diabetes-treatment market.

Collaboration Between Public and Private Sectors

The collaboration between public and private sectors is emerging as a significant driver for the type 1-diabetes-treatment market in South America. Partnerships between government agencies, healthcare providers, and pharmaceutical companies are fostering innovation and improving access to diabetes care. These collaborations often focus on research initiatives, clinical trials, and the development of new treatment protocols. For example, joint ventures have been established to enhance the availability of insulin and other essential medications in underserved areas. Such cooperative efforts are likely to enhance the overall healthcare infrastructure, thereby positively impacting the type 1-diabetes-treatment market.