Emergence of Advanced Analytics Technologies

The emergence of advanced analytics technologies is reshaping the software analytics market in South America. Innovations such as machine learning, predictive analytics, and real-time data processing are becoming increasingly accessible to businesses of all sizes. These technologies enable organizations to derive deeper insights from their data, facilitating more informed decision-making. As companies recognize the potential of advanced analytics, investments in these technologies are on the rise. Recent reports indicate that the adoption of machine learning tools in the region has increased by approximately 40% over the last year. This trend is likely to propel the software analytics market forward, as businesses seek to leverage cutting-edge technologies to gain a competitive edge and drive operational excellence.

Expansion of E-Commerce and Digital Services

The rapid expansion of e-commerce and digital services in South America is significantly influencing the software analytics market. With the increasing number of online transactions and digital interactions, businesses are compelled to adopt analytics solutions to understand consumer preferences and enhance user experiences. Recent data suggests that e-commerce sales in the region have grown by over 30% in the past year, prompting retailers to invest in software analytics tools to analyze purchasing patterns and optimize marketing strategies. This trend is expected to drive the software analytics market further, as companies strive to harness data for competitive advantage. The integration of analytics into e-commerce platforms is likely to become a standard practice, thereby fostering innovation and growth within the sector.

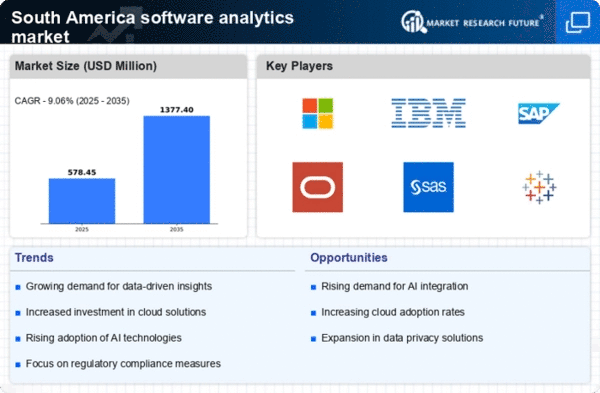

Rising Demand for Data-Driven Decision Making

The software analytics market in South America is experiencing a notable surge in demand for data-driven decision making. Organizations across various sectors are increasingly recognizing the value of leveraging data analytics to enhance operational efficiency and drive strategic initiatives. This trend is evidenced by a reported growth rate of approximately 25% in the adoption of analytics tools among businesses in the region. Companies are investing in software analytics solutions to gain insights into customer behavior, optimize supply chains, and improve overall performance. As a result, the software analytics market is poised for substantial growth, with projections indicating a potential market size of $1.5 billion by 2027. This shift towards data-centric strategies is likely to continue, as firms seek to remain competitive in an evolving marketplace.

Growing Focus on Customer Experience Enhancement

In South America, there is a growing focus on enhancing customer experience, which is significantly impacting the software analytics market. Companies are increasingly utilizing analytics tools to gather insights into customer preferences and behaviors, enabling them to tailor their offerings accordingly. This trend is particularly evident in sectors such as retail and hospitality, where personalized experiences are becoming a key differentiator. Recent surveys indicate that businesses investing in customer analytics have seen a 15% increase in customer satisfaction scores. As organizations prioritize customer-centric strategies, the demand for software analytics solutions is expected to rise, driving growth in the market. This emphasis on customer experience is likely to shape the future landscape of the software analytics market in South America.

Government Initiatives Supporting Digital Transformation

Government initiatives aimed at promoting digital transformation in South America are playing a crucial role in shaping the software analytics market. Various countries in the region are implementing policies to encourage the adoption of advanced technologies, including software analytics. For instance, initiatives that provide funding and resources for technology startups are fostering an environment conducive to innovation. As a result, businesses are increasingly turning to analytics solutions to comply with regulatory requirements and enhance service delivery. The software analytics market is likely to benefit from these government efforts, as they create a supportive ecosystem for technology adoption. This trend may lead to a projected increase in market growth, with estimates suggesting a potential rise of 20% in analytics tool utilization among public sector organizations.