Rising Cyber Threats

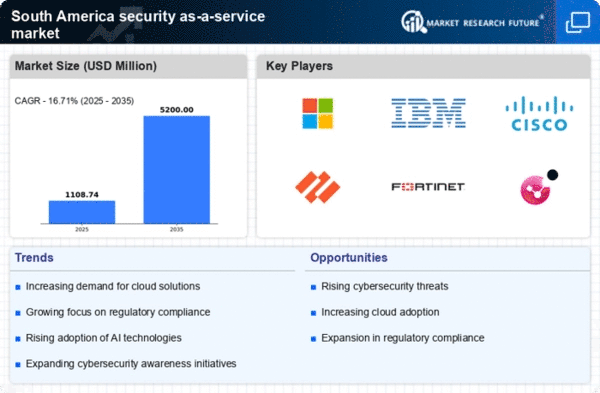

The escalating frequency and sophistication of cyber threats in South America is a primary driver for the security as-a-service market. Organizations are increasingly targeted by ransomware, phishing, and other malicious attacks, prompting a heightened demand for robust security solutions. In 2025, it is estimated that cybercrime could cost businesses in the region upwards of $150 billion annually. This alarming trend compels companies to seek comprehensive security as-a-service offerings that can provide real-time threat detection and response capabilities. As businesses recognize the potential financial and reputational damage from security breaches, investment in security as-a-service solutions is likely to surge, thereby propelling market growth.

Cost Efficiency and Scalability

The financial advantages associated with security as-a-service solutions are becoming increasingly apparent to organizations in South America. By adopting these services, companies can significantly reduce their capital expenditures on hardware and software, as well as minimize ongoing maintenance costs. In 2025, it is projected that organizations could save up to 30% on their overall security budgets by leveraging security as-a-service models. Furthermore, the scalability of these solutions allows businesses to adjust their security measures in accordance with evolving threats and operational needs. This flexibility is particularly appealing to small and medium-sized enterprises (SMEs) that may lack the resources to maintain in-house security teams, thus driving the growth of the security as-a-service market.

Regulatory Compliance Pressures

In South America, the increasing emphasis on regulatory compliance is a significant driver for the security as-a-service market. Governments are implementing stricter data protection laws and regulations, compelling organizations to adopt comprehensive security measures. For instance, the introduction of the General Data Protection Regulation (GDPR) has influenced local regulations, leading to heightened scrutiny of data handling practices. Companies that fail to comply with these regulations face substantial fines, which can reach up to €20 million or 4% of annual global turnover, whichever is higher. As a result, organizations are turning to security as-a-service solutions to ensure compliance and mitigate the risk of penalties, thereby fostering market growth.

Growing Awareness of Data Privacy

The increasing awareness of data privacy issues among consumers and businesses in South America is a crucial driver for the security as-a-service market. As data breaches become more prevalent, organizations are under pressure to protect sensitive information and maintain customer trust. Surveys indicate that over 70% of consumers are concerned about how their data is handled, prompting businesses to prioritize data protection measures. This heightened awareness is leading to a surge in demand for security as-a-service solutions that offer comprehensive data protection and privacy compliance features. As organizations strive to enhance their security posture and address consumer concerns, the security as-a-service market is poised for significant growth.

Integration of Advanced Technologies

The integration of advanced technologies such as artificial intelligence (AI) and machine learning (ML) into security as-a-service offerings is driving innovation in the market. These technologies enhance threat detection and response capabilities, allowing for more proactive security measures. In South America, the adoption of AI-driven security solutions is expected to grow by 25% annually, as organizations seek to leverage data analytics for improved security outcomes. This trend indicates a shift towards more intelligent security frameworks that can adapt to emerging threats. Consequently, the security as-a-service market is likely to expand as businesses recognize the value of incorporating advanced technologies into their security strategies.