Rising Cyber Threats

The increasing frequency of cyber threats in South America is a primary driver for the healthcare iot-security market. As healthcare organizations adopt IoT devices, they become more vulnerable to cyberattacks, which can compromise sensitive patient data. Reports indicate that cyber incidents in the healthcare sector have surged by over 30% in recent years. This alarming trend compels healthcare providers to invest in robust security measures to protect their networks and patient information. Consequently, the demand for advanced security solutions tailored for IoT devices is expected to rise significantly. The healthcare iot-security market must adapt to these evolving threats by implementing comprehensive security frameworks that address vulnerabilities and ensure compliance with data protection regulations.

Increased Patient Engagement

The rise in patient engagement through digital health platforms is a significant driver for the healthcare iot-security market. As patients become more involved in their healthcare journeys, they increasingly utilize IoT devices to monitor their health and communicate with providers. This trend necessitates the implementation of robust security measures to protect patient data and maintain trust. With an estimated 60% of patients in South America using digital health tools, the demand for secure IoT solutions is likely to grow. Healthcare organizations must prioritize the security of these devices to ensure patient confidentiality and data integrity. Consequently, the healthcare iot-security market is poised for growth as providers seek to enhance security in response to this trend.

Regulatory Frameworks and Standards

The establishment of regulatory frameworks and standards in South America is influencing the healthcare iot-security market. Governments are increasingly recognizing the need for stringent regulations to protect patient data and ensure the security of healthcare systems. For example, the implementation of data protection laws similar to the General Data Protection Regulation (GDPR) in Europe is becoming more common. These regulations mandate that healthcare organizations adopt specific security measures for IoT devices, thereby driving demand for security solutions. As compliance becomes a critical factor for healthcare providers, the healthcare iot-security market is expected to expand as organizations seek to meet these regulatory requirements and avoid potential penalties.

Investment in Digital Health Solutions

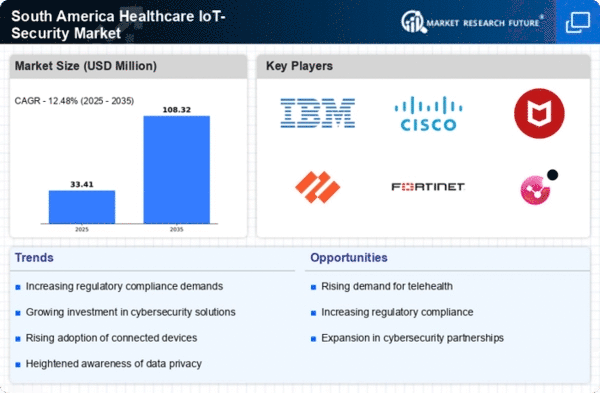

The growing investment in digital health solutions across South America is propelling the healthcare iot-security market. Governments and private entities are increasingly funding initiatives aimed at enhancing healthcare delivery through technology. For instance, the South American digital health market is projected to reach $10 billion by 2026, indicating a robust growth trajectory. This influx of capital encourages the development of secure IoT devices and applications, as stakeholders recognize the importance of safeguarding patient data. As healthcare providers integrate more IoT technologies into their operations, the need for effective security measures becomes paramount. Thus, the healthcare iot-security market is likely to experience substantial growth driven by these investments.

Technological Advancements in Security Solutions

Technological advancements in security solutions are driving innovation within the healthcare iot-security market. As cyber threats evolve, so too must the technologies designed to combat them. The development of artificial intelligence and machine learning applications for threat detection and response is becoming increasingly prevalent. These technologies can analyze vast amounts of data in real-time, identifying potential security breaches before they occur. In South America, the adoption of such advanced security solutions is expected to increase, with market analysts projecting a growth rate of 25% over the next five years. This trend indicates that the healthcare iot-security market will continue to evolve, as organizations seek to leverage cutting-edge technologies to enhance their security posture.