Growing Interest in Women's Health

The phytoestrogen supplements market is witnessing a growing interest in women's health, particularly regarding hormonal balance and reproductive health. South American women are increasingly turning to phytoestrogen supplements as a means to support hormonal health during various life stages, including menstruation, pregnancy, and menopause. This trend is supported by market data indicating a 25% increase in sales of women's health supplements over the last two years. The emphasis on natural and plant-based solutions aligns with the preferences of modern consumers, who are more informed about the benefits of phytoestrogens. As awareness of women's health issues continues to rise, the phytoestrogen supplements market is likely to benefit from this heightened focus, leading to further innovation and product development.

Aging Population and Health Concerns

The demographic landscape in South America is shifting, with an increasing proportion of the population aged 50 and above. This demographic trend is significantly impacting the phytoestrogen supplements market, as older adults often seek solutions to manage menopausal symptoms and maintain overall health. Research suggests that phytoestrogens may play a role in alleviating symptoms such as hot flashes and mood swings, making them an attractive option for this age group. The market is projected to grow by 20% in the next five years, driven by the rising health concerns associated with aging. As the population continues to age, the demand for phytoestrogen supplements is expected to expand, reflecting a broader trend towards preventive health measures among older adults.

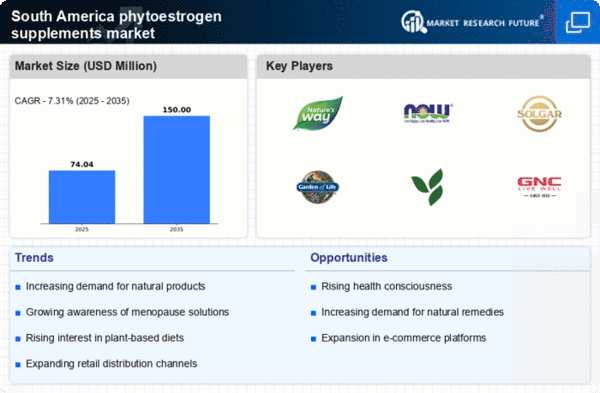

Increasing Demand for Natural Remedies

The phytoestrogen supplements market in South America is experiencing a notable surge in demand for natural remedies. Consumers are increasingly seeking alternatives to synthetic hormones, driven by a growing awareness of the potential side effects associated with conventional treatments. This shift towards natural solutions is reflected in market data, indicating that the sales of phytoestrogen supplements have risen by approximately 15% over the past year. The inclination towards holistic health approaches is likely to further bolster the phytoestrogen supplements market, as more individuals prioritize wellness and preventive care. Additionally, the cultural acceptance of herbal and plant-based products in South America enhances the appeal of phytoestrogen supplements, positioning them as a preferred choice for many health-conscious consumers.

Influence of Social Media and Health Trends

The phytoestrogen supplements market is significantly influenced by social media and emerging health trends. Platforms such as Instagram and TikTok have become vital channels for health influencers to promote the benefits of phytoestrogen supplements, reaching a broad audience in South America. This digital marketing approach appears to resonate particularly well with younger consumers, who are increasingly interested in health and wellness. As a result, the market has seen a 30% increase in online sales of phytoestrogen supplements in the past year. The ability to share personal testimonials and success stories on social media may further drive consumer interest and acceptance of these products, potentially leading to sustained growth in the phytoestrogen supplements market.

Rising Health Consciousness and Lifestyle Changes

The phytoestrogen supplements market in South America is benefiting from a broader trend of rising health consciousness and lifestyle changes among consumers. As individuals become more aware of the impact of diet and lifestyle on health, there is a growing inclination towards supplements that support hormonal balance and overall well-being. This trend is reflected in market data, which indicates a 40% increase in the consumption of dietary supplements, including phytoestrogens, over the last three years. The shift towards healthier eating habits and the desire for preventive health measures are likely to propel the phytoestrogen supplements market forward. As consumers continue to prioritize their health, the demand for phytoestrogen supplements is expected to grow, driven by a commitment to holistic wellness.