Growth of E-commerce Platforms

The phytoestrogen supplements market is benefiting from the rapid growth of e-commerce platforms in the GCC. With the increasing penetration of the internet and mobile devices, consumers are more inclined to purchase health supplements online. E-commerce provides convenience, a wider selection of products, and often competitive pricing. Recent data indicates that online sales of health supplements in the GCC have surged by 20% in the past year. This shift towards online shopping is likely to enhance the visibility and accessibility of phytoestrogen supplements, thereby attracting a broader consumer base and driving market growth.

Aging Population and Hormonal Changes

The demographic shift towards an aging population in the GCC is a significant driver for the phytoestrogen supplements market. As individuals age, they often experience hormonal changes that can lead to various health issues, particularly among women during menopause. The demand for supplements that can help manage these changes is on the rise. Market analysis suggests that the population aged 50 and above is expected to grow by 15% over the next decade in the GCC. This demographic is increasingly turning to phytoestrogen supplements as a natural means to alleviate symptoms associated with hormonal fluctuations, thereby contributing to the market's expansion.

Increasing Awareness of Health Benefits

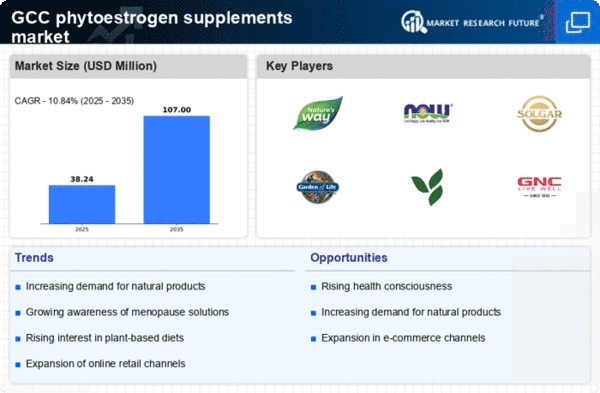

The phytoestrogen supplements market is experiencing growth due to rising awareness among consumers regarding the health benefits associated with phytoestrogens. These compounds, found in various plants, are believed to alleviate menopausal symptoms, support hormonal balance, and promote overall well-being. As educational campaigns and health information become more accessible, consumers in the GCC are increasingly seeking natural alternatives to synthetic hormone therapies. This trend is reflected in market data, which indicates a projected growth rate of approximately 8% annually in the region. The increasing focus on preventive healthcare and wellness is likely to further drive demand for phytoestrogen supplements, as consumers prioritize natural solutions for their health concerns.

Influence of Social Media and Influencers

The phytoestrogen supplements market is being significantly influenced by social media and health influencers in the GCC. As platforms like Instagram and TikTok gain popularity, influencers are increasingly promoting natural health products, including phytoestrogen supplements. This trend has the potential to shape consumer perceptions and drive purchasing decisions. Recent surveys indicate that approximately 30% of consumers in the region are influenced by social media recommendations when choosing health supplements. The visibility and endorsement of phytoestrogen supplements by trusted figures in the health and wellness community may lead to increased consumer interest and market growth.

Rising Interest in Holistic Health Approaches

There is a notable trend towards holistic health approaches among consumers in the GCC, which is positively impacting the phytoestrogen supplements market. Individuals are increasingly seeking natural remedies and lifestyle changes to improve their health, rather than relying solely on conventional medicine. This shift is reflected in the growing popularity of dietary supplements that support hormonal health and overall wellness. Market Research Future indicates that holistic health products are projected to grow by 10% annually in the region. As consumers become more educated about the benefits of phytoestrogens, the demand for these supplements is likely to rise, further propelling market growth.